Though often delayed by the majority, wealth creation and retirement planning are the most crucial aspects of financial wellbeing for anybody, irrespective of their financial strata or social standing. One of the most efficient and effective way of achieving them is through a disciplined and regular ways of investing in Systematic Investment Plans (SIPs). Investing in SIPs early in your career can have a profound impact on your retirement plans and the wealth you accumulate over time. Let us explore the power of starting early for retiring wealthy.

The Power of Compounding

Compounding is often termed the “eighth wonder of the world” due to its exponential impact on investments. The best way to avail the benefits of compounding is to start investing early so that the time can work wonders in giving exponential growth. SIPs, along with a disciplined approach, facilitate reinvestment of your returns, allowing your wealth to compound at a much-accelerated pace.

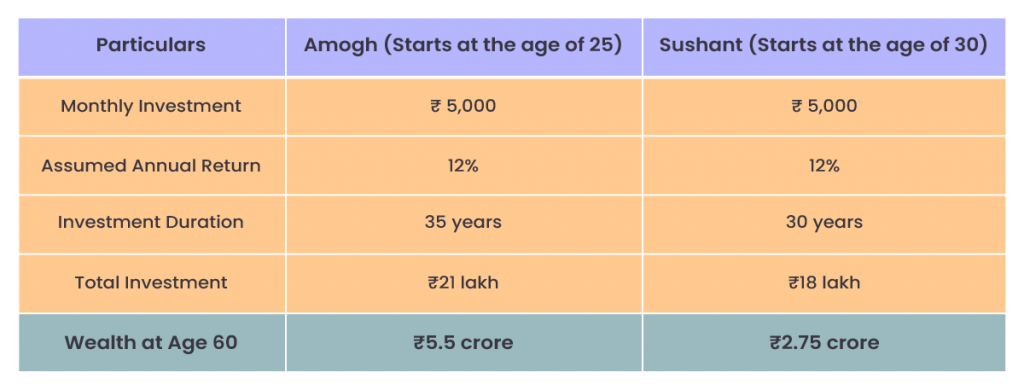

A person who starts investing in SIPs at the age of 25 will accumulate almost twice the wealth compared to someone who begins at the age of 30. Let us imagine two friends, Amogh & Sushant.

Amogh starts investing in a SIP at the age of 25, contributing ₹5,000 per month with an assumed annual return of 12%. Sushanth delays his investment journey and starts at 30, contributing the same ₹5,000 per month with the same return of 12%.

By the time they both turn 60, here is how their wealth would compare.

The Magic of Starting Early with SIPs:

Just a 5-year head start made Amogh’s wealth almost double that of Sushant’s. This showcases the incredible power of compounding and the importance of starting early with SIPs.

Navigating Market Volatility through Rupee Cost Averaging

SIPs allow investors to navigate market volatility through rupee cost averaging. With investments being made at regular intervals, investors can buy more units when prices are low and fewer units when the situation is the reverse, resulting in the average cost per unit being reduced over time. By investing early, one can sail through market fluctuations, allow market corrections to pass through without any anxieties and reap the benefits of long-term investments by staying invested. It is crucial to know that more time in the market allows for exponential wealth creation.

Financial Discipline and Habit Formation

Starting SIPs early instils financial discipline. By setting aside a portion of income for investments from an early stage, one can not only reduce unnecessary expenses but also cultivate a habit of structured savings which fosters financial growth in the long run. By utilizing advancements in technology, investors can schedule automated deductions for SIPs from their bank accounts, ensuring timely investments with minimum effort and no hassles.

Conclusion

Starting SIPs early is one of the most powerful financial planning decisions, paving the way for a secure and wealthy retirement. One can harness the power of compounding, rupee cost averaging, and fostering financial discipline. Additionally, SIPs offer tax benefits through equity funds, making them a tax-efficient investment choice as well. By beginning early and investing consistently, one can achieve financial independence and retire stress-free and securely.

If you have not started yet – it is never too late; the best time to begin securing your wealthy retirement is now!

Start your investment journey early to secure your financial future and retire wealthy!

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply