There are certain questions in life for which there is no one-size-fits-all answer. Individuals have to take decisions depending on the stage of life they currently are in terms of their professional, financial, and social circumstances. Should I buy or rent a house? —is one such age-old question that has continued to stir debates among the youths, families, entrepreneurs, salaried individuals, middle-aged professionals, and retirees: all alike. With real estate prices skyrocketing and rents soaring at an equally fast pace, taking the right decision often becomes difficult yet crucial.

This blog explores key factors – both financial and emotional with realistic 15-year financial comparison which helps you to take the right decision.

I. Financial Factors: Let’s Talk Money.

A. EMI vs Rent

Your monthly home loan EMI (Equated Monthly Installment) would be usually higher than the rent. Renting frees up your capital that can be invested elsewhere.

The difference between the EMI and the rent is your investment opportunity

B. Down Payment Lock-in

Buying a house would need you to pay a lump sum amount towards down payment. If you rent instead, such lumpsum amount can be immediately invested.

An approximate lump sum of ₹25 lakh could grow to over ₹1 Crore in 15 years at a CAGR of 10%.

C. Hidden Ownership Costs

Buying a house is not just about payment of EMIs, it also involves property tax, repairs and maintenance, renovation, insurance, etc.

These extra costs are often overlooked in buying vs renting decisions which are your investment opportunities in case you opt for rent.

D. Real estate vs other investments

Real estate may fetch on an average 4-7% of returns per annum. However, depends on the location. Equity/ Mutual funds fetch on an average 10-12% per annum in the long term.

Investing the surplus while renting can compound faster than property appreciation in many cases. However, market-linked investments carry risks and require careful consideration

E. Liquidity

Selling of property can take time and involve lots of paperwork while the other investments like mutual funds/stocks are easier to exit and have funds.

Liquidity matters during uncertain or emergency situations, especially when you are too young to build a corpus dedicated towards uncertain events.

II. Beyond the Numbers – The Emotional and Lifestyle Factors

A. Age and Lifestyle

If you are older or nearing retirement, Buying gives you security and stability. If you are younger, flexibility might be your need and renting might suit.

B. Emotional Satisfaction

Buying gives you freedom to personalize and gives a sense of belonging. As a tenant, one might come across with restrictions and emotional detachment.

C. Mobility and Career Freedom

Renting gives the freedom to shift between cities, switch jobs and explore new areas. Buying limits such flexibility and might be difficult for those in their 20s and 30s.

D. Location for Peaceful and Lifestyle

Buying allows permanent residence in a lifestyle-suited location (peaceful locality, close to family or friendly neighbourhood). In such desirable areas, high rental costs can make buying a more practical and cost-effective choice.

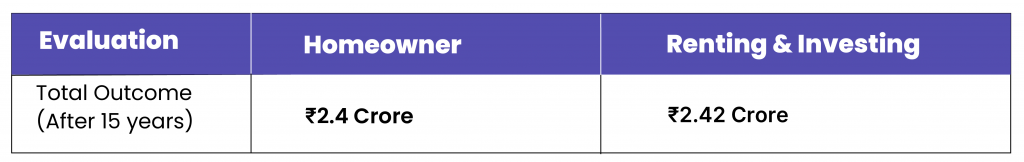

III. Homeowner vs Smart Investor – A 15-Year Reality Check

Sundar, a 32-year-old IT Professional living in Bengaluru. He is financially disciplined, earns well and is now in a dilemma that “Should I buy a home worth ₹1 Crore? Or continue renting and invest the difference?

A. Path 1: Buying his dream home –

- 1 Crore apartment

- ₹20 Lakh down payment 15-year home loan of ₹80 Lakhs at 8% interest rate

- ₹50,000 would be approximate annual maintenance, property tax and repairs.

- After 15 years, he’s loan-free and the house is his home.

- The property is assumed to be appreciated at 4% per year.

B. Path 2: Renting and Investing Wisely –

- ₹30,000 rent per month

- Rent increases by 5% every year.

- He invests the downpayment and the difference between the EMI and rent in a mutual fund which yields 10% CAGR.

Let’s evaluate both the options and see what would happen over the next 15 years

1. Final Comparison (Assuming 4% Property Appreciation)

2. A twist – What if the Property grows at 6% instead of 4%?

With a 6% property appreciation, the buy vs rent decision hits a financial tie, wherein the non-financial factors like location, flexibility, emotional, etc pitches in and guides the decision.

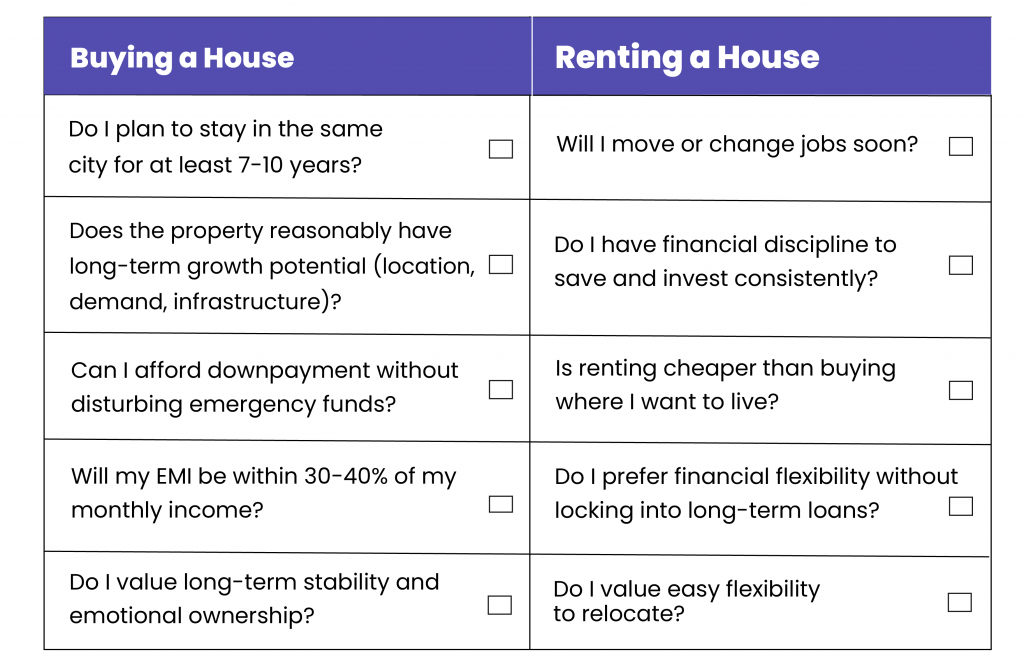

IV. What is Right for You?

Buying is not always a smarter choice and Renting is not always waste of money. It is not at all one-size-fits-all answer. One needs to evaluate various critical factors discussed above to arrive at a right decision. It is a mix of numbers and emotions, both equally important. The best decision would be the one which balances your financial and emotional goals. To make it easier, here’s a simple self-evaluation checklist that aids in your decision journey:

Whichever column has more checks likely reflects what suits you best. You can use this as a guide to help make your decision

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply