Introduction

Though often used interchangeably, the terms savings and investing are fundamentally two different financial strategies. For many individuals, whether to put their hard-earned money on savings or investments is a perennial dilemma —like wondering whether to open a fixed deposit (FD) or invest in stocks and mutual funds. It is important to note that both are significant in your financial journey and play distinct roles while fulfilling your aspirations. In this article, we will guide you on how to distinguish between the two and make informed decisions in your financial journey.

What is Saving?

Saving is the portion of your income that you set aside for future needs or emergency situations. Your savings need to be readily available, but they do not yield high returns, especially in a changing economic environment with rising inflation. Your money deposited in your savings accounts, fixed deposits, or recurring deposits are the most common examples of savings, which focus on safety, easy access, and capital preservation.

Savings are primarily meant to fulfil your short- to mid-term goals, such as building an emergency fund, funding a vacation, purchasing a car, etc. They ensure meeting your immediate goals and needs without worrying about market volatility. Savings provide essential financial stability and make sure that you and your loved ones are protected against unforeseen challenges.

What is Investing?

Investing is allocating your money into various instruments that have the capacity to yield higher returns over time. Investing requires you to choose certain assets, including stocks, real estate, mutual funds, gold, etc., which offer opportunities for substantial growth but also come with inherent risks. Investing is aimed at building your wealth over the long term. Financial objectives such as retirement plans, your children’s educational expenses, buying your dream home or even building a legacy are some of the most common examples of long-term plans. By investing, you aim to grow your money at a rate that outpaces inflation and ensures that your wealth expands over time to meet your aspirations.

Save or Invest?

The right approach while choosing between saving and investing is not “either-or”; it is about creating a thoughtful balance between the two. While they serve different purposes, both are essential and often move on parallel tracks in your financial journey. It is always recommended to begin with a safety net – a savings buffer that covers around 3 to 6 months of essential expenses – and once this foundation is in place, you can gradually start exploring further savings and investment options that align with your medium- and long-term goals, taking into account both your risk tolerance and risk capacity. If you’re unsure where to start or how to move forward, even a basic consultation with a financial advisor would help to build a plan that fits your goal.

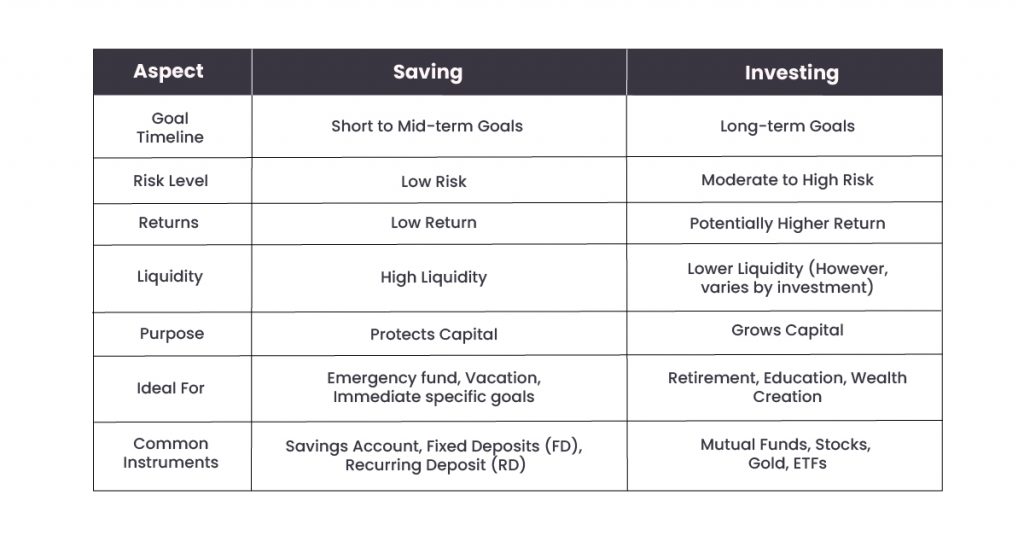

Here’s a quick comparison to help you understand the key differences between the two:

Conclusion

It is important for every individual to understand the difference between savings and investing and it is essential to know that you need both.

- Relying on savings alone makes you struggle to keep up with inflation.

- Relying only on investing makes you vulnerable for financial emergencies and other short-term goals.

It is of paramount importance to prioritise your goals and then decide how much to allocate for savings or investments. So, the next time you wonder, “Should I save or invest?”, remember that the key to this paradox is balance.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply