I. Introduction

Have you ever questioned whether your financial goals align with your ability to take risks? Or whether you are overcautious when you could, in fact, afford to aim higher? Answering these questions begins with understanding the often confused but fundamentally different two concepts: risk tolerance and risk capacity. Let us delve into this blog to understand the concepts and key distinctions which can align your investment choices with both your mindset and your means.

II. What is Risk Tolerance?

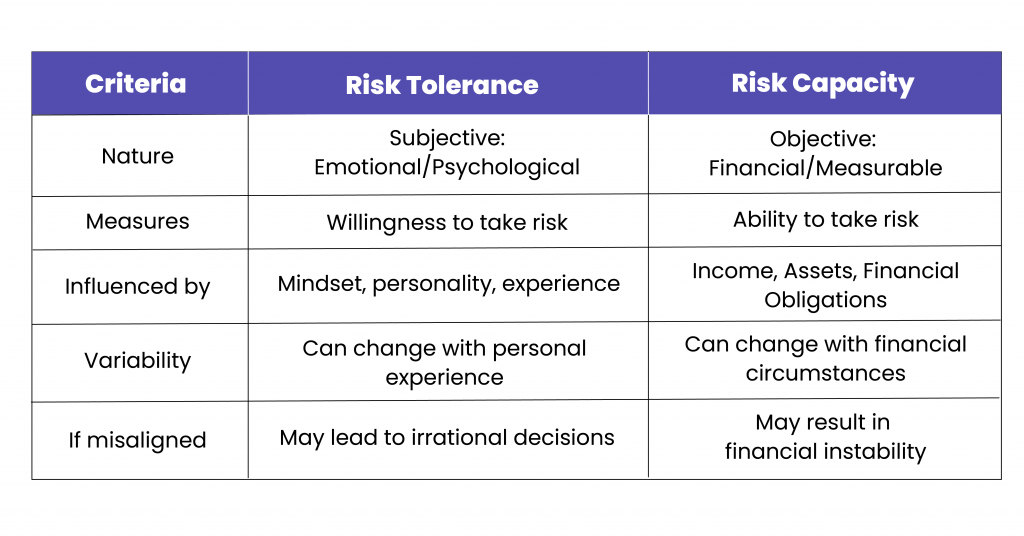

Risk tolerance refers to the emotional and psychological comfort an individual has with investment volatility and potential losses. It is also a reflection of your mindset tendencies when dealing with uncertainty. Risk tolerance is subjective, and it varies based on personal traits and past experiences. It may not necessarily be linked to one’s financial situation.

For instance, During a market downturn:

- Some investors may stay positive and calm and remain committed to long-term investment strategies.

- On the hand, others can panic and decide to withdraw their investments, potentially locking in losses.

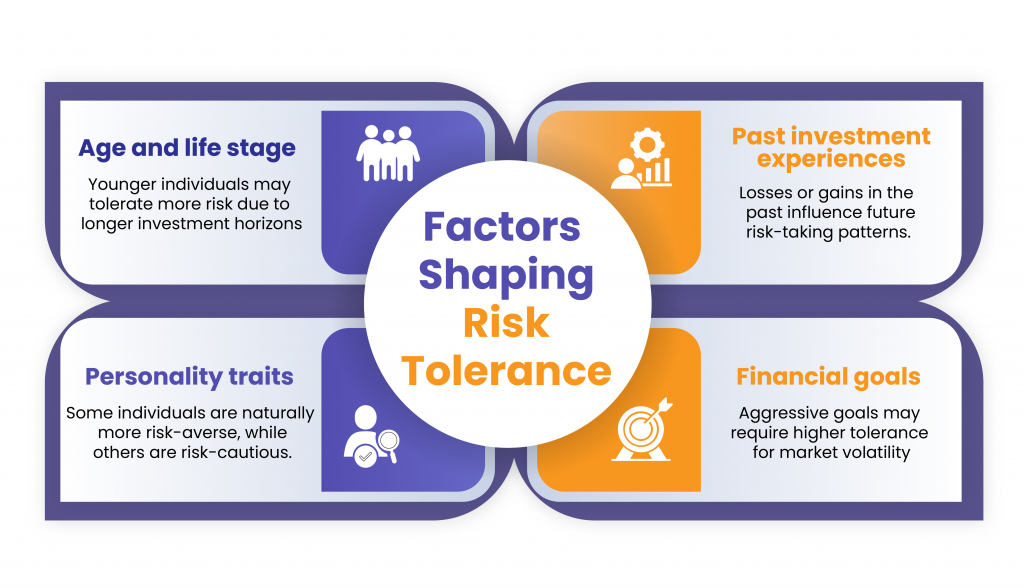

A. Factors Shaping Risk Tolerance:

III. What is Risk Capacity?

Unlike risk tolerance, risk capacity is objective and measurable. It refers to the financial ability to bear risk and absorb losses without hampering financial goals. Even if you are willing to take risks, your risk capacity is the enabler in deciding whether it is wise to do so.

For instance, Risk tolerant investors during a market downturn:

- Investors with a stable income, low debt, and an emergency fund might stay invested comfortably, knowing their long-term goals remain secure.

- On the other hand, investors with an unstable income profile and no financial cushion may be forced to exit the market. They ideally shouldn’t have taken on that level of risk in the first place.

A. Factors Shaping Risk Capacity:

Risk capacity involves a thorough financial assessment which helps to determine how much risk you can take without compromising your essential financial goals.

IV. Risk Tolerance vs Risk Capacity: Key Differences

A. For Example:

- A person may be highly risk tolerant, but lack of financial backing can cause setbacks.

- A person with high-risk capacity but lower risk tolerance may miss out on long-term gains due to extremely conservative decisions.

Conclusion

Recognizing the difference between risk tolerance and risk capacity is essential for building smart financial plan. While risk tolerance reflects your emotional readiness, risk capacity defines your financial ability. When you align both, you can avoid unnecessary financial setbacks and take decisions that are both practical and personalized. Ultimately, this understanding helps you to achieve your financial goals with greater confidence and clarity.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply