In today’s fast paced life and evolving economic scenario, effective management of personal finances has become critical for every individual. Personal finance is an umbrella term that comprises various aspects of an individual’s finances, and a Personal Finance Manager (PFM) is the one responsible for managing your finances effectively and efficiently. The role of a PFM is to ensure that no important aspect of your finances goes unmanaged and to take informed decisions on behalf of you that can strengthen your financial health and secure your financial future. In the constantly evolving financial landscape of today, though quite a few people are managing their personal finances on their own, the need for a PFM to take care of your financial affairs has been widely acknowledged.

Understanding Personal Finance & Its Key Components

Personal finance refers to the strategic management of an individual’s financial activities, which includes streamlining the opportunities for income generation, tracking and managing the spendings, savings, and investments, along with adopting a proper mechanism to protect the individual’s assets. The main objective of personal financial management is to ensure the financial stability of the individuals while enabling them to achieve their desired personal financial goals. The key components of personal finance, where the role of PFM comes into the picture, include:

A. Income Management

Income of an individual comprises cash flows generated from the individual’s salary, investments or business profits. An efficient income management system for an individual consists of effective management of the sources of their income along with making informed and correct decisions on their investments.

B. Saving for the Future

Savings are crucial for individuals to achieve their long-term goals and sustain themselves in the long run. A PFM’s role is to ensure that the individual possesses an emergency fund that is capable of covering around six to eight months of the living expenses in the event of an emergency and to enable him to take care of the funds required to achieve his goals when the right time comes for investments to be made.

C. Expense Management

Every individual is required to distinguish his (or her) expenses on the basis of their requirements and luxury. The role of PFM includes ensuring that the essential and discretionary expenses are categorised and taken care of on the basis of priority and future availability of funds. PFM can help stop overspending and accumulation of unnecessary debts.

D. Portfolio Management

A well-informed and well-planned investment strategy that considers both the risks and returns is essential for effective personal finance management. A balanced and managed allocation of funds into assets like stocks, bonds, or real estate helps grow wealth and achieve long-term financial goals.

E. Asset Protection

Implementing an effective method of protecting the assets of an individual is a pivotal part of personal finance management. Contingency mechanisms such as insurance policies that cover important aspects of life, such as life, health, and disability insurance, safeguard people at the advent of unforeseen situations. Such protective measures ensure stability for individuals during unexpected and challenging situations of life.

Role of Your PFM in Handling of Your Personal Finances

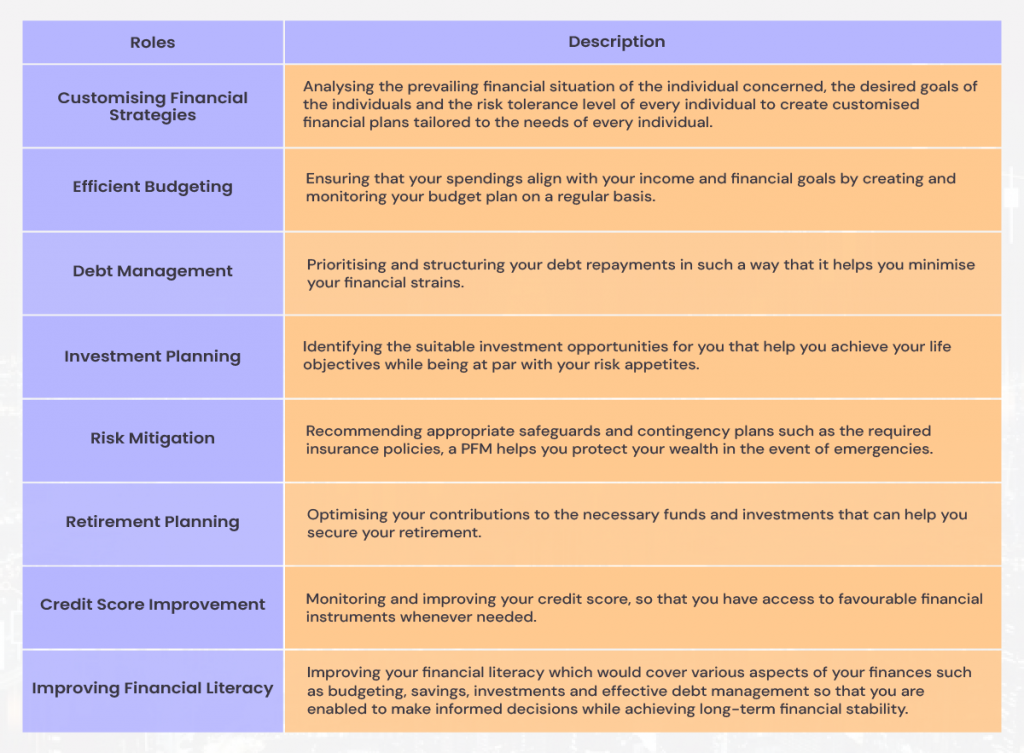

The role of your personal finance manager consists of helping you make informed decisions on your finances, preparing you for contingencies, and also helping build a secured financial future for you. His (or her) role is to act not only as a financial guide to you but also to play the role of your friend, philosopher and guide, helping you navigate your investments and savings and effectively manage your sources of income. Let us have a detailed understanding of the key roles played by your PFM that can help you have strong and stable financial health.

Key Responsibilities of a PFM:

Conclusion

Managing personal finances is an essential life skill. But the complexities involved in the effective management of your personal finances entail professional expertise, and here comes the role of your Personal Finance Manager (PFM). By effectively using your PFM’s expertise, individuals can navigate their financial landscapes efficiently while achieving the desired in life. Personal Finance Managers (PFMs) also ensure that your investments are aligned with your life objectives while financial stability remains a top priority all along.

Contributors:

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply