Planning your finances and investments is not just about growing your wealth; it is also about safeguarding yourself and your loved ones from uncertainties during unforeseen events. Preparation for uncertain times is the key to successful financial planning. In continuation of our previous blog on various savings schemes for Indian taxpayers, here is our latest take on risk-mitigating areas that also offer you tax benefits.

1. Medical Insurance Coverage

Health emergencies may arise at any time, and the expenditure incurred could be overwhelming. Health or medical insurance schemes are meant to provide you with a safety net that can ease your financial burden during such crisis situations. You can avail health insurance plans, mitigate risk and claim tax benefits under Section 80D of the Income Tax Act, 1961.

Several government-initiated health insurance schemes are also available, such as the

- Ayushman Bharat Yojana: Provides health insurance coverage up to ₹5 lakhs per family per year for eligible low-income groups.

- Pradhan Mantri Suraksha Bima Yojana: Offers accidental insurance coverage at an affordable premium of ₹20 per annum and many more.

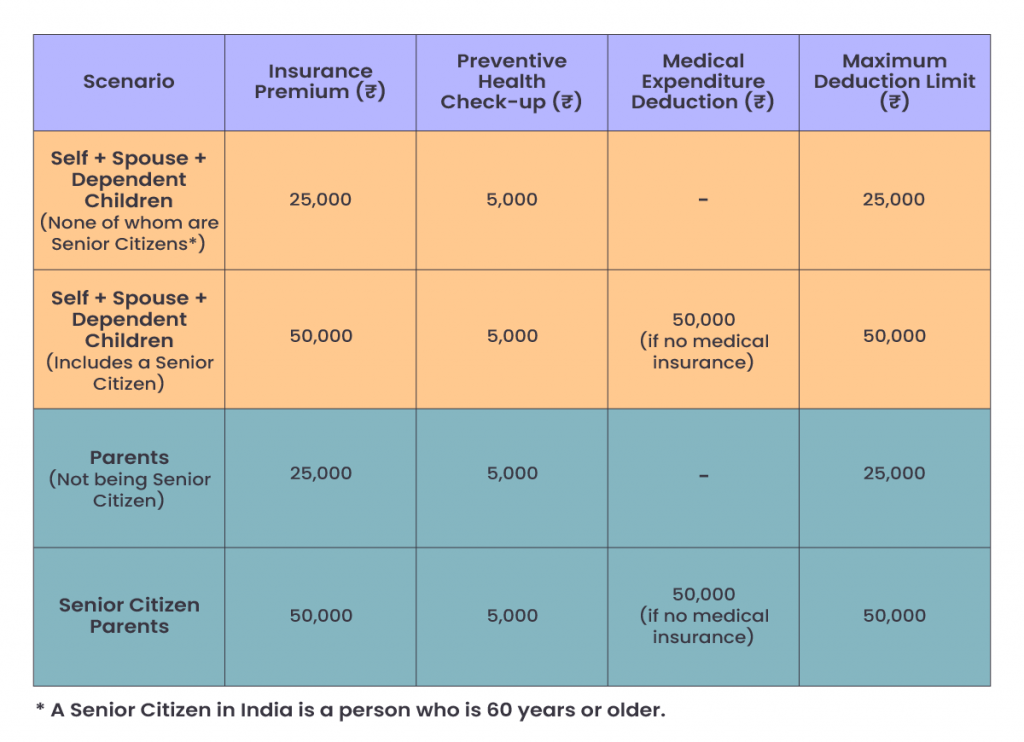

Let us have a quick look at the tax deductions available from total income as per Section 80D of the Income Tax Act, 1961, in the table below:

Important Notes:

1. Maximum Deduction under Section 80D:

- Self + Spouse + Dependent children: the maximum deduction allowable is ₹50,000

- Parents: the maximum deduction allowable is ₹50,000.

- Hence, the total maximum deduction under Section 80D would be ₹100,000

2. Contributions to the Central Government Health Scheme (CGHS):

- Self + Spouse + Dependent children: If any contributions are made towards CGHS, such amounts also shall qualify for deductions within the limits specified in the above table.

3. Cash payments are not eligible for tax benefits, except for preventive health check-ups.

2. Life Insurance Coverage

Life insurance is one of the most prominent instruments that provides security to your near and dear ones in the event of your death. In addition to monetary compensation, life insurance also offers tax-saving and exemption benefits under Sections 80C and 10(10D) of the Income Tax Act. Some of the key tax benefits of life insurance are:

- Premiums paid for life insurance policies (covering self, spouse, and children) are eligible for deduction under Section 80C (up to ₹1.5 lakh per annum).

- For policies issued after April 1, 2012, maturity proceeds from life insurance policies are exempt under Section 10(10D), provided the annual premium does not exceed 10% of the sum assured.

- In case of the policyholder’s death, the amount received by nominees is fully exempt from tax under Section 10(10D), regardless of premium percentage.

- Term insurance plans with riders for critical illness, surgical care, or hospital care qualify for tax benefits under Section 80D within the limits.

Conclusion

It must be noted that the tax deductions under Sections 80C and 80D are available under the old tax regime only, while the exemption under Section 10(10D) would be available both under the old and new regimes.

However, your financial planning should not just be limited to savings, it should also focus on risk mitigation. By investing in medical and life insurance, you can secure your family from unforeseen financial burdens while also availing applicable tax benefits. Therefore, awareness of such options and leveraging the benefits is vital for every individual to build a stable and protected future.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply