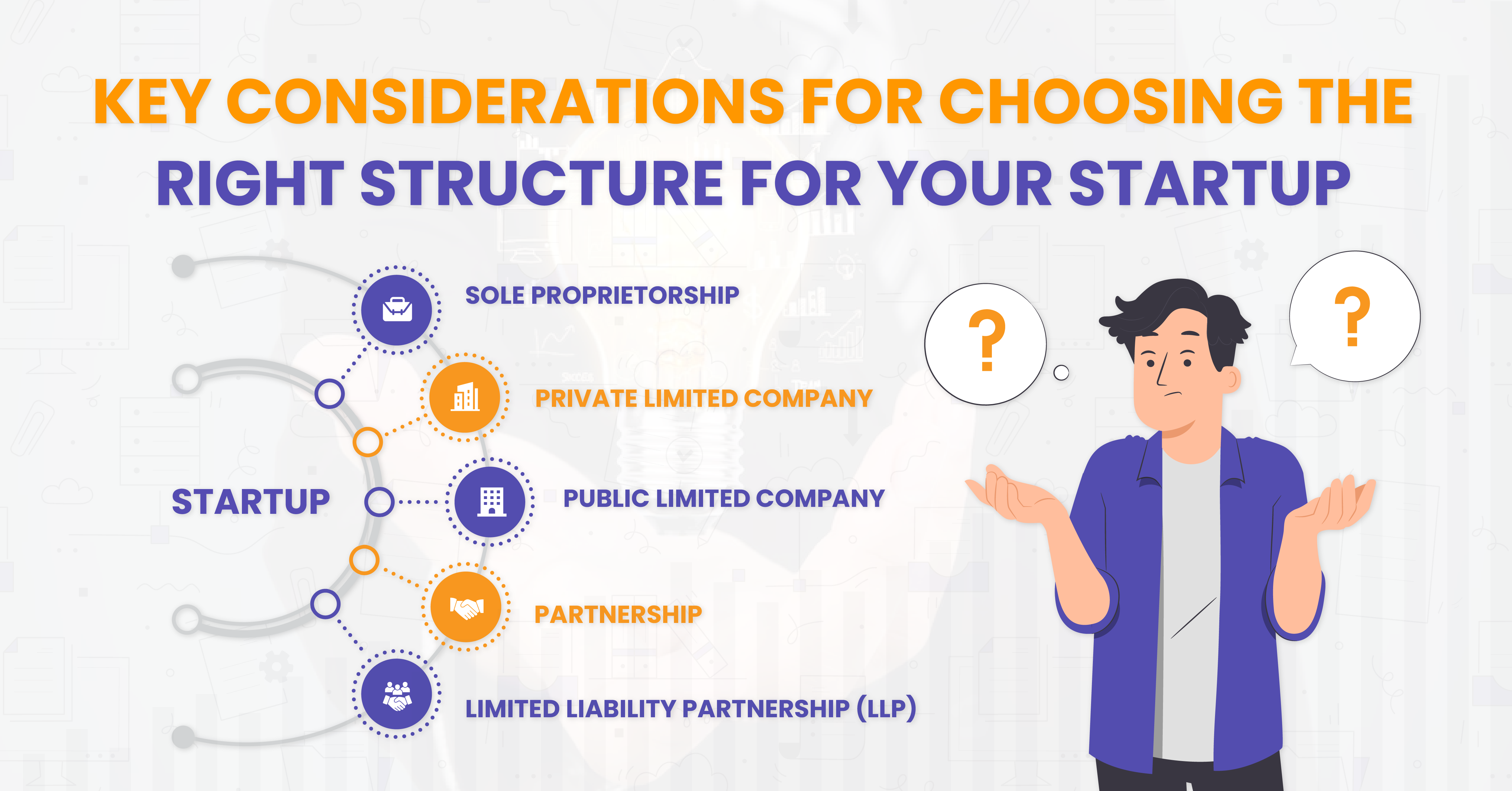

Entrepreneurs have various business structures to choose from, to base upon their Startup ventures. The entire task of setting it up, managing the taxes, the operational flexibility, and subsequent liabilities associated with the entity would vary accordingly with this choice. Therefore, it is imperative for Startup entrepreneurs to gain in-depth knowledge on various aspects of each of these structures and then decide on the business model to go ahead with.

Some of the common business structures at hand and the important business aspects associated with each of them are listed below:

Sole Proprietorship

Governing Laws: No particular law governs this structure.

Liabilities: Unlimited liability: The owner is personally liable for all business debts.

Need for Annual Filings: No formal annual filings are required, but the owner must file income tax returns annually.

Flexibility to raise external Equity capital: Not suitable

Transferability: Difficult to transfer ownership, usually requires the sale of assets unless inherited.

Taxation: Profits are taxed as the personal income of the owner (individual income tax rates, including self-employment tax).

Private Limited Company

Governing Laws: Companies Act, 2013

Liabilities: Limited liability: Shareholders’ liability is limited to the value of shares they hold.

Need for Annual Filings: Must file annual audited financial statements along with an annual return with the Registrar of Companies (RoC).

Flexibility to raise external Equity capital: Suitable

Transferability: Transfer of shares is restricted and requires approval from Bord of Directors; shares are not publicly traded.

Taxation: Corporate tax on profits (currently 25-30%). Shareholders are taxed on dividends and capital gains.

Public Limited Company

Governing Laws: Companies Act, 2013 & Securities and Exchange Board of India Act, 1992 (if listed)

Liabilities: Limited liability: Shareholders’ liability is limited to the value of shares they hold.

Need for Annual Filings: Must file annual audited financial statements, along with an annual return with the RoC.

Flexibility to raise external Equity capital: Suitable

Transferability: Shares are freely transferable on the stock exchange, if listed.

Taxation: Corporate tax on profits (currently 25-30%). Shareholders are taxed on dividends and capital gains.

Partnership

Governing Laws: Partnership Act, 1932

Liabilities: General partners have unlimited liability.

Need for Annual Filings: No formal annual filing requirement, but the partnership must file annual income tax returns.

Flexibility to raise external Equity capital: Limited Options

Transferability: Changes in Partner and in contribution will happen based on Agreement and with the consent of all the partners

Taxation: Partnership firms are taxed on profits. Only the renumerations and interests on capital are taxed in the hands of partners.

Limited Liability Partnership (LLP)

Governing Laws: Limited Liability Partnership Act, 2008

Liabilities: Limited liability: Partners’ liability is limited to their contribution by deed to the LLP.

Need for Annual Filings: Requires filing an annual return and financial statements with the RoC.

Flexibility to raise external Equity capital: Limited Options

Transferability: Changes in Partner and in contribution will happen based on Agreement and with the consent of all the partners.

Taxation: LLP is taxed on profits. Only the renumerations and interests on capital are taxed in the hands of partners.

Therefore, entrepreneurs must carefully choose the correct business structures for their startups after a detailed and careful analysis of all the advantages and disadvantages associated with each structure, be it sole proprietorship, private limited company, public limited partnership, or LLP—based on their business goals and the circumstances that shape their choice of business, finances, career ambitions, and targets. Prior consultations with legal and financial advisors are a must if you are not clear about all the aspects involved in it and undecided on your choice.

Contributors:

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply