Input GST credit can be cross-utilized for payment of other tax liabilities, this means that a credit component of Central Goods and Services Tax (CGST) / State Goods and Services Tax (SGST) can be utilized for Integrated Goods and Services Tax (IGST), and vice versa.

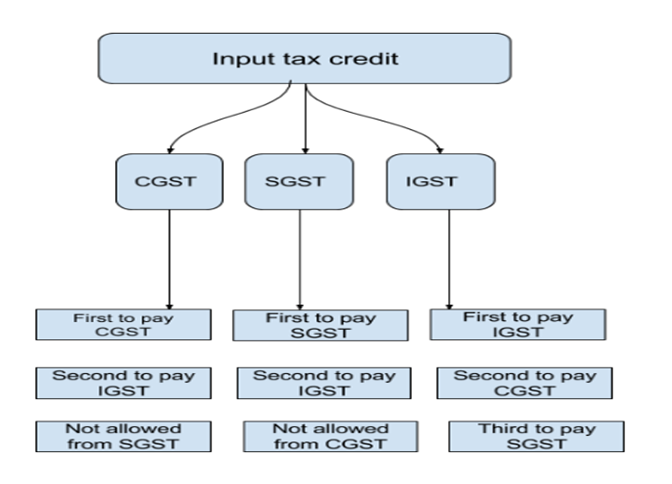

The Law on the order of Input Tax Credit (ITC) set-off is mentioned as under:

Rule 88A – Order of utilization of ITC:

- ITC on IGST

- IGST credit will be first set off against IGST liability.

- The remaining amount, if any, may be utilized towards payment of CGST first.

- And then towards SGST.

It should be noted that IGST credit should be mandatorily exhausted completely.

- ITC on CGST

- CGST credit will be first set off against CGST liability.

- The remaining amount to be used only against IGST liability.

It must be noted that CGST credit cannot be set off against SGST liability.

- ITC on SGST

- SGST credit will be first set off against SGST liability.

- The remaining amount to be used only against IGST liability.

It must be noted that SGST credit cannot be set off against CGST liability.

Cross Utilization of GST Input Cash Credit

The amount of cash deposited for IGST, CGST, and SGST can be utilized only against the payment of IGST, CGST, and SGST, respectively.

It must be noted that no inter-head adjustments are allowed for major heads.

Cash deposited in minor head i.e., Tax/Interest/Fee/Penalty/Others in the cash ledger can be utilized for payment of Tax/Interest/Fee/Penalty/Other Liabilities, respectively, of the same major head. No minor head adjustment is allowed.

Leave a Reply