Introduction

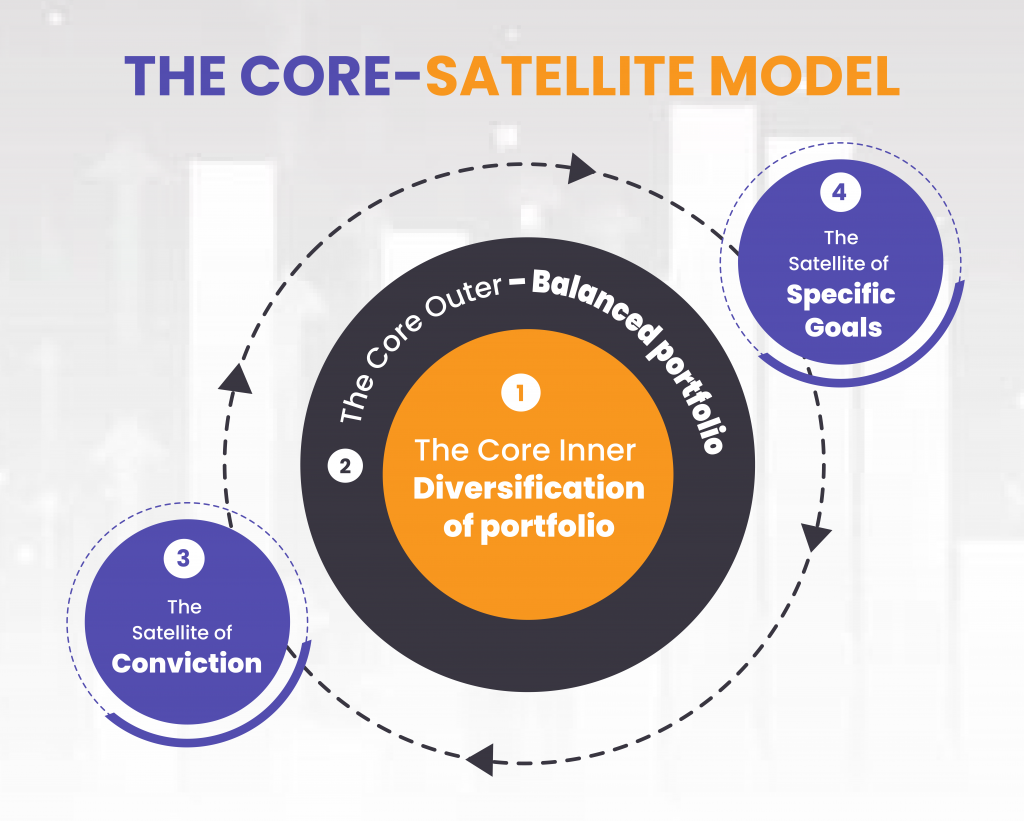

When it comes to building a sound financial future, selecting the right investment mix is essential. While both balanced and diversified portfolios are often used interchangeably, they are different in their approach towards investment risk management. In this article, we’ll explore the core-satellite model that can structure your investments effectively, incorporating conviction-based and goal-based investments, which may sometimes surpass traditional strategies, depending on your financial objectives.

I. The Core Inner – Diversification of portfolio:

The core of your portfolio offers stability and long-term growth by spreading investments across a wide range of sectors and asset classes. They can be built using mutual funds, index funds, ETFs, including separate allocations to gold, real estate, or debt instruments to diversify beyond equities. This approach helps to reduce exposure to any single company, sector, or trend, minimizing unsystematic risk. Diversification protects your portfolio from being excessively invested in areas that may underperform, allowing better-performing investments to compensate.

II. The Core Outer – Balanced portfolio:

A balanced investment strategy builds on to the core by introducing a structured alignment with your risk profile – your risk tolerance and risk capacity. Unlike the core inner, where diversification primarily aims to minimize unsystematic risk, the balanced portfolio uses diversification along with finding the right mix of risk and return, based on your personal financial situation and goals. It enables your portfolio to grow in a way that is not just steady, but also with potential for higher returns in line with your risk preferences and abilities.

III. The Satellites – Conviction and Specific Goals:

The Satellite of Conviction: This satellite reflects high-conviction investments based on strong beliefs in specific themes or market trends. These investments may follow certain principles of diversification, or a balanced portfolio, but they can also go beyond such boundaries. For instance, you might invest in emerging technologies, startups, or sustainable businesses that align deeply with your personal values or market outlook, even if they carry higher risk than your capacity typically allows.

These investments can surpass returns provided by the core, if your predictions and convictions prove right. However, such decisions should be made with caution, as conviction does not eliminate the inherent volatility and downside risk these investments may carry.

The Satellite of Specific Goals: This satellite targets time-sensitive or unconventional financial goals, such as starting a business, taking a career break, or achieving an early retirement. While it may follow a few core principles of diversification and balance, it focuses on reaching specific milestones within a defined timeline and hence might involve aggressive strategies surpassing the boundaries. Specific goals are not just for wealth accumulation, they are for specific achievements, and hence these investments can stretch beyond your financial capacity and should be approached with caution due to the higher risks involved.

Conclusion

By combining the diversification for stability and balanced portfolio for potential growth at the core layers, along with exponential risk-reward opportunities at the satellites layer, the core-satellite model offers a comprehensive investment strategy. Whether you’re just starting or refining your investment structure, this model provides a tailored roadmap for building a resilient and purpose-driven portfolio.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply