Author: ITeCApp

-

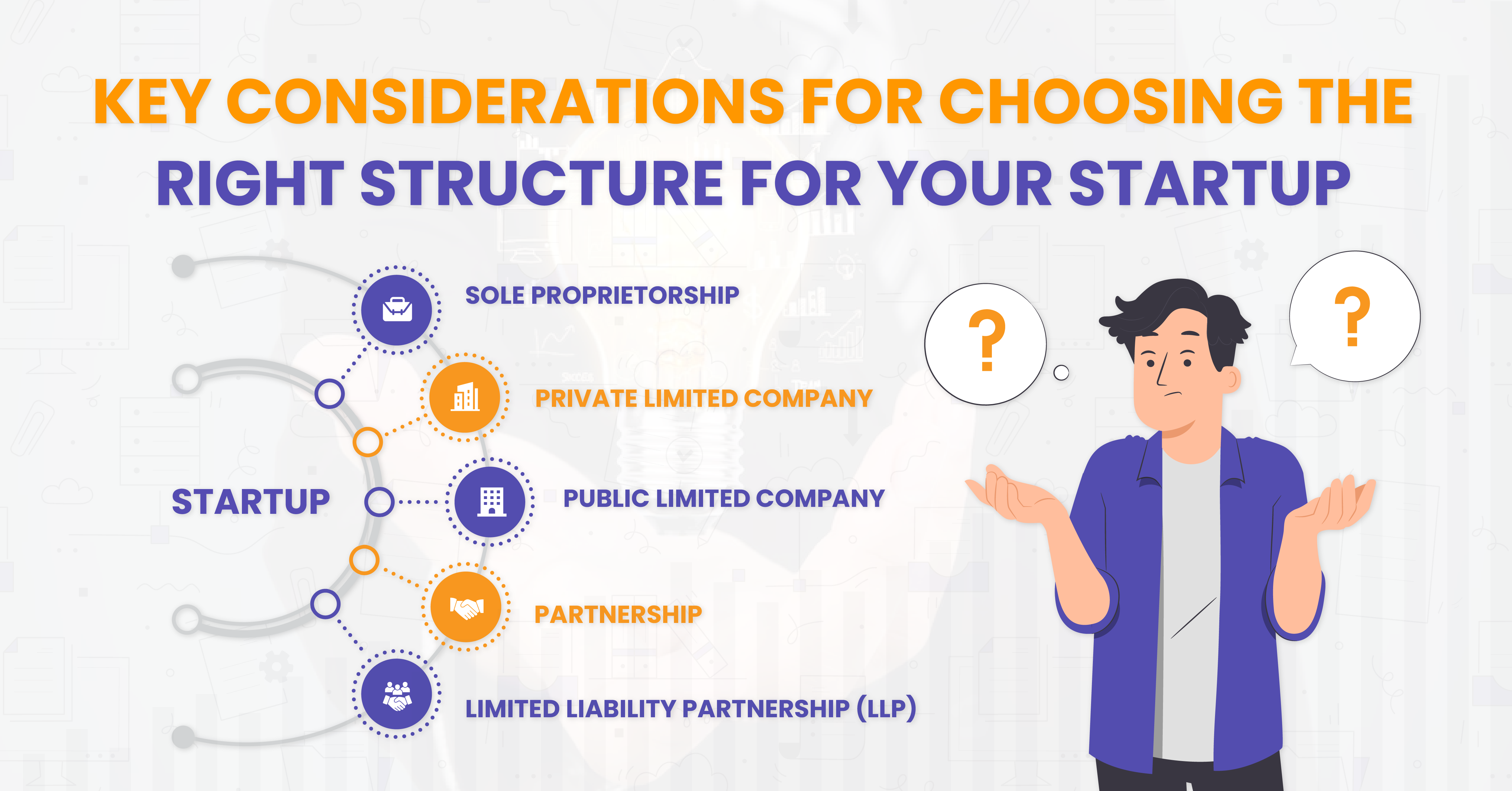

Key Considerations for Choosing the Right Structure for Your Startup

Entrepreneurs have various business structures to choose from, to base upon their Startup ventures. The entire task of setting it up, managing the taxes, the operational flexibility, and subsequent liabilities associated with the entity would vary accordingly with this choice. Therefore, it is imperative for Startup entrepreneurs to gain in-depth knowledge on various aspects of…

-

Take Control of Your Finances Today

A Disciplined Approach to Financial Health Life moves fast, and it’s easy to let our finances take a backseat. Neglecting little financial leakages can lead to big problems down the road. Therefore, it is critical to manage finances efficiently to reduce your financial stress. By tackling the financial issues head-on, you can protect the hard-earned…

-

Smart Money Moves to Make Before Your Next Salary Day

Managing your finances efficiently is one of the most effective steps that you can take to improve your financial future. Next salary day arrives: It’s time to plan and save taxes. Here are some intelligent money moves in the Indian context: Create and Maintain a Budget To know where the money goes, start by listing…

-

Managing Your Personal Finances

Managing your personal finances is pivotal to building a strong foundation, which is crucial for all your financial battles. A structured approach in handling money can significantly improve one’s financial management and stability. Here’s a concise guide to help in achieving the same. Set clear Financial Goals Always dream big and start small; set clear…

-

Impact of Digital Currency in the Global Market: An Indian Perspective

Digital currency, popularly known as cryptocurrency, has revolutionised the global financial landscape, and India is no exception. As the world shifts towards a digital economy, the presence of digital currencies in India has also been significant. Let us in this article, try to delve deeper into the entire process and chronology of events in India…

-

Ensuring Compliance with the Changes in Income Tax Rules

Stay Updated on Changes The first step in staying compliant to the tax laws is to keep a regular track of the latest updates in income tax laws. These changes, which come through Finance Acts [which are presented at the time of the Union Budget] and amendments, can affect things like tax rates, exemptions, and…

-

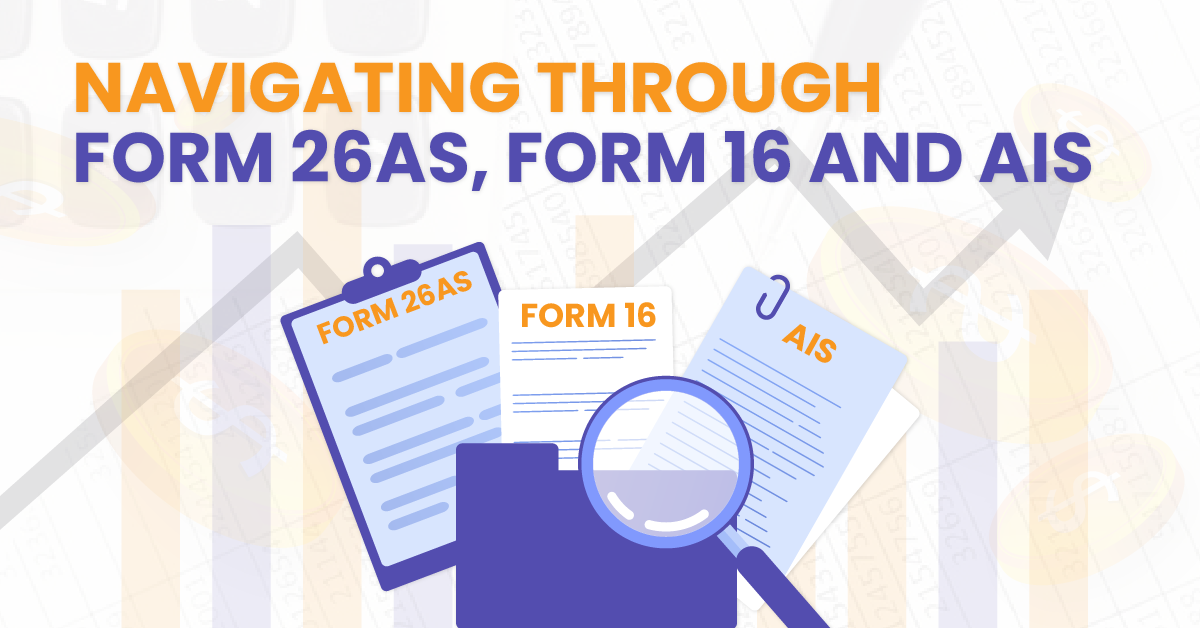

Navigating through Form 26AS, Form 16 and AIS

The Income Tax Department knows all your financial transactions even if you don’t tell! How? Through three forms viz. The combined details from these Forms tell the Income Tax Department, all about your income, major expenses and investments. Let’s get into the nitty-gritty of each of these documents. Form 26AS Whenever tax is deducted from…

-

The Startup Ecosystem in India: A Landscape for Growth and Innovation

The evolution of the Startups and its consistent growth has been the major driving force behind the rapid economic expansion and the innovation boom that India has undergone in the recent time. With the emergence of a flourishing entrepreneurial economy aided by the advent of government initiatives such as the Startup India, these ventures are…

-

Financial Checklist for Job Switch

Switching jobs for better pay or position? Before you start your new journey, refrain from committing these financial mistakes. Here is the Financial Checklist that you must check while switching jobs. EPF Account There is a very important EPF hack that you need to know about. If you withdraw your PF balance before 5 years,…

-

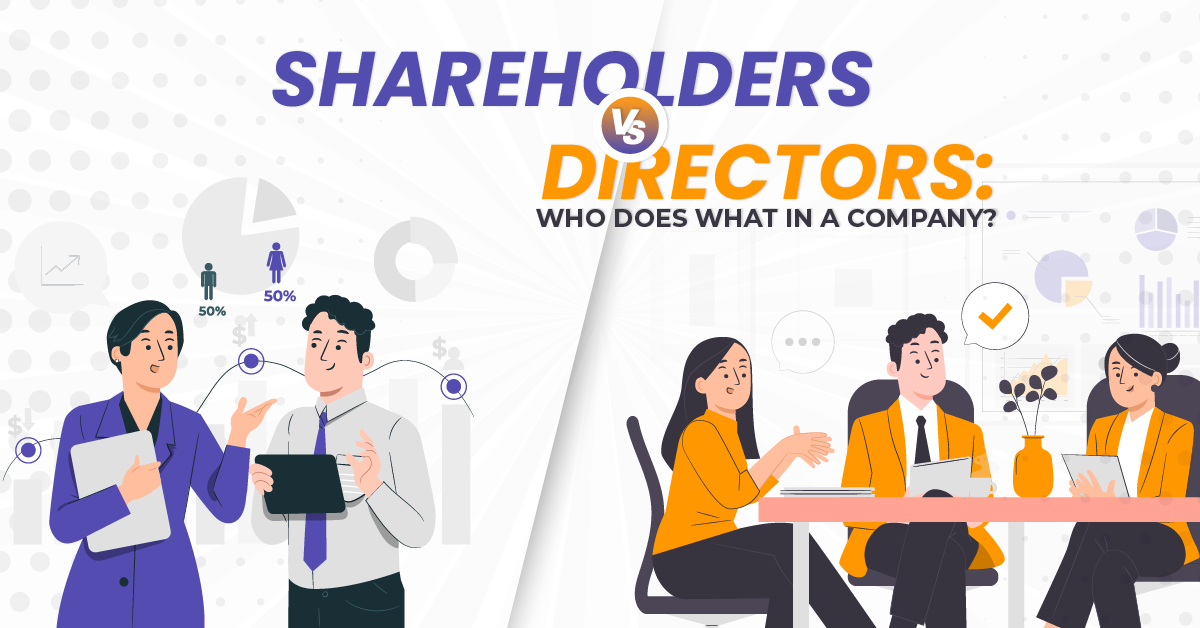

Shareholders vs Directors: Who Does What in a Company?

Have you ever guessed who the owner of the company is? Shareholders or Directors? If Shareholders are owners, then what are Directors for? Let’s clear up any confusion in this article. Shareholders and Directors both act in tandem to conduct the affairs of the company. The Board of Directors is like the mind behind the…