Introduction

Building on our previous blog, where we provided income tax slabs and key components of tax computation, this post will take a closer look at some of the key provisions. These points will help you understand their impact and how they fit into the tax framework.

Key considerations before opting for the New Regime

A. Restrictions on Deductions in the New Regime

While the new regime offers subsidized slab rates when compared to the old regime, it comes with a cost of unavailability of lots of deductions. There were no changes to these provisions in Budget 2025. A few such restricted deductions and exemptions are described below:

1. Chapter VIA Deductions

- Employer contribution to pension scheme up to 14% of salary u/s 80CCD(2)

- Amount deposited in the Agniveer Corpus Fund u/s 80CCH(2)

- Additional employee cost u/s 80JJAA are the only three deductions under Chapter VIA

- The rest of the deductions u/s 80C, 80D, 80E, 80TTA, etc. (covering most of the prominent deductions) aren’t available under the new regime.

2. Income from Salary

- A few key exemptions and deductions under the head income from salaries, like Professional Tax (PT), House Rental Allowance (HRA), Leave Travel Allowance (LTA), etc. are not available under the new regime.

- However, other prominent ones like exemptions on voluntary retirement u/s 10(10C), gratuity u/s 10(10), and leave encashment u/s 10(10AA) continue to be present in the new regime as well.

3. Income from House Property

- Interest on housing loan of self-occupied/vacant property u/s 24 is not allowed as a deduction under the new regime.

- Only interest on a housing loan of a let-out property is allowed as a deduction against the income from such property. Additional interest on such property, if any, is not allowed to be set off against other heads of income or available for carry forward.

4. Income from business or profession

- For individuals having income from business, a few deductions like additional depreciation u/s 32(1)(iia), expenditure on scientific research u/s 35, specified business u/s 35AD, etc. aren’t available under the new regime.

B. Marginal Relief in the New Regime

Marginal relief is a mechanism to ensure fairness for taxpayers whose income crosses certain thresholds. It is not a new concept; it has been there for surcharge limits and for the new regime rebate eligibility limit is of Rs. 7,00,000. Similarly, post revision of rebate limits in Budget 2025, marginal relief would be applicable for the new regime rebate eligibility limit of Rs. 12,00,000 as well.

If the tax liability resulting from crossing a threshold exceeds the additional income above such threshold, then the tax would be capped at such additional income.

For example,

- a total income of Rs. 7,10,000 in the new regime doesn’t result in a tax liability of Rs. 21,000 in line with the slab rates. It would be restricted to Rs. 10,000 (as it is the additional income exceeding the threshold of Rs. 7,00,000).

- Applicable health and education cesses would be added further.

C. Taxation of Income chargeable at special rates

The Act requires certain types of income to be taxed at special rates (Short Term Capital Gain on specific securities u/s 111A and Long-Term Capital Gain u/s 112) and not the standard slab rates. There has been significant debate on whether the 87A rebate can be applied to taxes on income taxed at special rates. The government is not inclined to offer such a rebate, and hence the same has been clarified in the Budget 2025. From FY 2025-26, rebate would not be applicable for tax on income chargeable at special rates. But, since the Government has not mentioned anything about its retrospective effect, it has opened the door to potential disputes up to FY 2024-25.

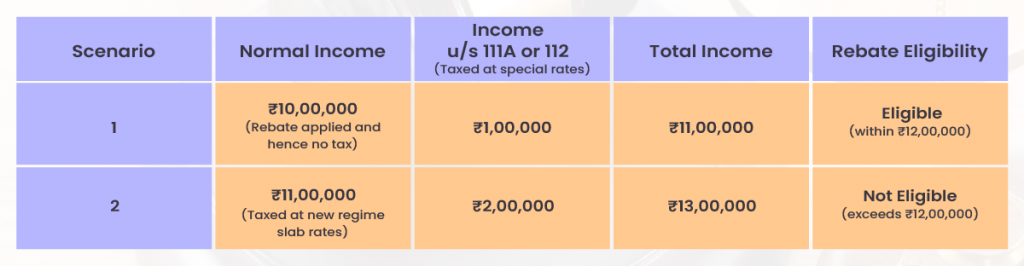

Further, if the total income does not cross the rebate limit, the person would be eligible for rebate and income chargeable at special rates if any, would be taxed at special rates. However, if the income including the income chargeable at special rates crosses the rebate limit, then the entire income becomes ineligible for the rebate. Below is the example table showing the impact.

D. Option to Choose

Since there are 2 regimes for determining tax liability, choosing an option becomes critical. Currently, the new regime is the default regime, and those who want to pay taxes under the old regime need to choose such an option. The manner of choosing the option is as below:

- Individual with Business or Professional Income

- Submit Form 10IEA within the due date to file the return of income

- Can withdraw their option once in the future, with no re-selection allowed.

- Individual without Business or Professional Income

- Opt-out of the new regime while filing the Income Tax Returns

Conclusion

While the new regime offers simplified tax rates, it also comes with certain restrictions and provisions to consider. It’s important to keep these in mind when making tax-related decisions.

In our next blog, we will take a closer look at tax liabilities, using examples to show how these provisions affect your tax positions under both the old and new regimes.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply