Introduction

Zero-based Budgeting (ZBB) is an impact budgeting method that has gained global acclaim in the world of financial planning. Developed in the 1970s by business expert Peter Pyhrr, ZBB requires all expenses to be justified for each new period, rather than past budgets forming the basis of future spending patterns. Known for its “Start from Scratch” approach, where every expense requires justification, ZBB has been pivotal in aligning the spendings with goals, thereby enhancing efficiency and accountability. Let us explore more about this powerful budgeting method in this blog.

Key Features of Zero-Based Budgeting

Some of the major features of ZBB include:

- Start from Zero – No Assumptions: ZBB does not entail a speculative process where expenditures are contemplated relying on historical data. Every budgeting cycle begins afresh from a “Zero Base” and no previous budget is carried forward.

- Priority-Based Budget Allocation: Budget allocations are done based on the necessity and priority of each activity. This ensures that the most critical operations receive the funding first, rather than following uniform allocation based on past budget trends.

- Granular Justification: Since the budgetary allocation process entails cost evaluation for each function, every line item must be justified from the ground up.

- Critical Department Level Responsibility: Each department head is responsible for justifying the costs involved in their area, making ownership and accountability an integral part of the budgeting activities.

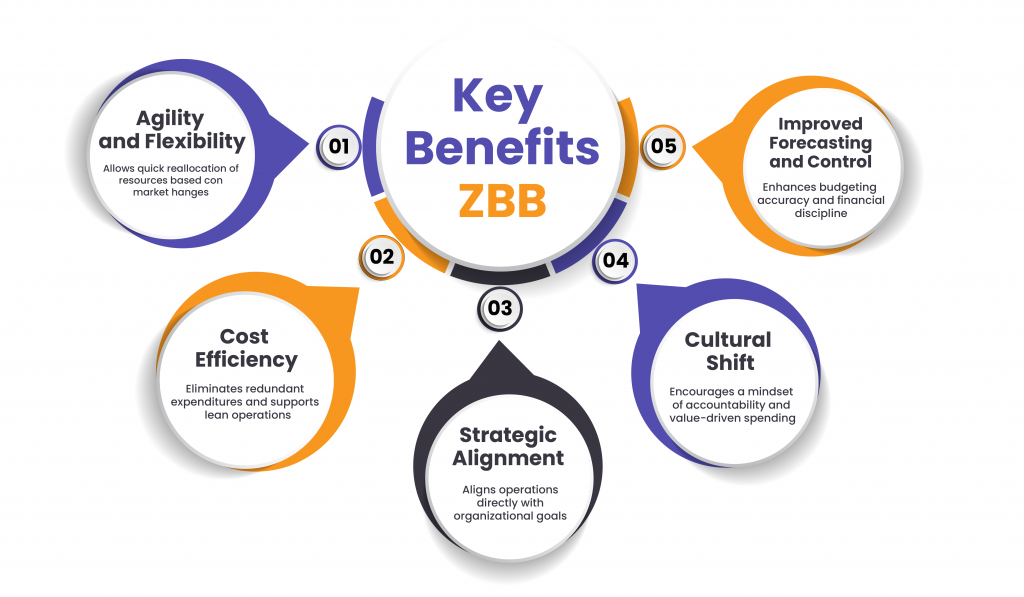

Why Businesses Are Embracing Zero-Based Budgeting

With the ever-increasing pressure on businesses to optimise their operational costs and enhance financial agility, organisations across industries, including global giants like Kraft Heinz, Guess, Unilever, etc., are looking at zero-based budgeting to achieve a greater level of efficiency, instil financial discipline and become more strategic in their approach.

Challenges of Implementing Zero-Based Budgeting

- Time-Consuming Process: Building budgets from scratch, every cycle can be time-consuming.

- Training and System Requirements: Effective implementation of ZBB requires specialized training and robust financial systems.

- Resistance to Change: Increased scrutiny and structural changes may lead to resistance from employees, especially those accustomed to traditional practices.

Conclusion

Zero-Based Budgeting is not just a new budgeting methodology; it is a strategic mindset shift. Whether you are running a startup, a mid-sized business, or even managing personal finances, the ZBB approach offers a disciplined way to control your spending patterns. In today’s dynamic world, ZBB empowers businesses and individuals to make smarter, purpose-driven financial decisions.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply