In continuation of our previous blog on the key changes to the TDS provisions, this blog focuses on the amendments to Tax Collected at Source (TCS) provisions introduced in the Union Budget 2025. Such amendments aim at rationalizing the tax collections and easing out the compliances. Let us delve into this blog to stay updated on the key changes to the TCS provisions proposed to be effective from April 1, 2025.

TCS Amendments for Foreign Remittances

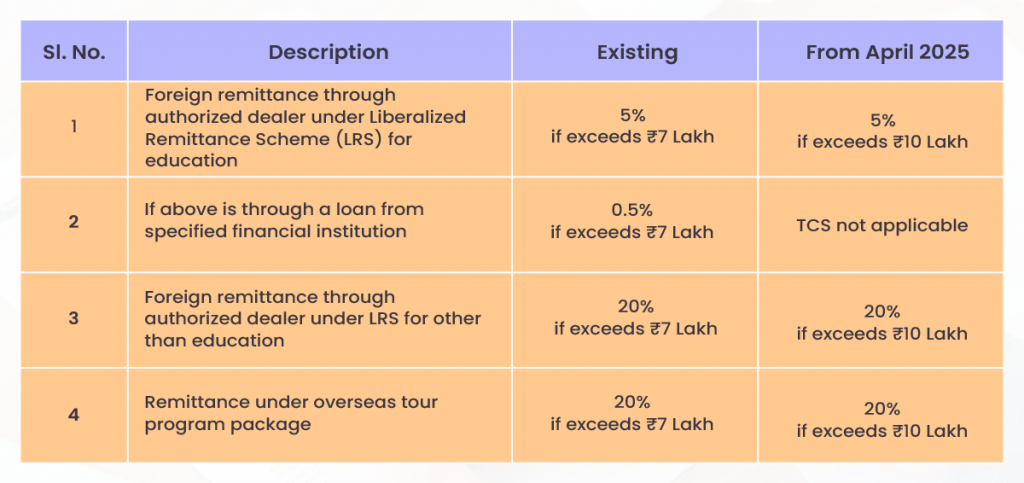

Under section 206C(1G) on TCS on foreign remittances, provisions have been amended through certain exemptions and changes in threshold limits for TCS applicability. Let’s take a quick look at the following table for these modifications.

TCS Amendments – Other Compliances

- Section 194Q requires buyers to deduct TDS at 0.1% on purchases exceeding ₹50 lakh, while 206C(1H) requires sellers to collect TCS at 0.1%.

- To avoid compliance confusion, TCS under 206C(1H) is removed, leaving only TDS to remain with effect from April 2025.

- More clarity has been provided for the term “forest produce”, and the TCS rate has been reduced on the sale of timber and other forest produce from 2.5% to 2% under Section 206C(1).

- Section 206CCA, which required higher rates of TCS for non-filers of Income Tax Returns, has been removed.

- Section 276BB mandates prosecution for failing to deposit TCS. From April 2025, this Section becomes liberal if TCS is paid before the quarterly filing deadline, leading to ease of compliance.

Conclusion

These changes in TCS represent a major change towards reducing the taxes and making compliance easier. Staying up to date with these changes is crucial and could significantly reduce the chances of compliance complications or untoward liabilities.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply