Significant changes to the Tax Deducted at Source (TDS)provisions were introduced in the Union Budgets 2024 and 2025 presented by the Finance Minister of India. These changes have been brought in with the aim of rationalizing the provisions involved in the collection of TDS, while alleviating the difficulties involved and easing the compliance burden on the taxpayers. Let us delve into this blog to stay updated on the key changes to the TDS provisions proposed to be effective from April 1, 2025.

1) Introduction of a New TDS Provision

A new TDS provision would be applicable from April 1, 2025, under Section 194T which requires partnership firms and LLPs to deduct TDS on payments made or credited to partners’ accounts. Payments in salary, remuneration, commission, bonuses or interest exceeding ₹ 20,000 in a financial year attract TDS at the rate of 10%.

2) Relaxation for TDS on Salaries

Under the new tax regime, rebate eligibility has been raised from the limit of ₹ 7 Lakhs to ₹ 12 Lakhs for individual taxpayers. This results in a significant reduction in the number of employees falling under TDS on Salaries under Section 192. Employers can significantly reduce administrative workloads and time spent on compliance activities with effect from April 1, 2025.

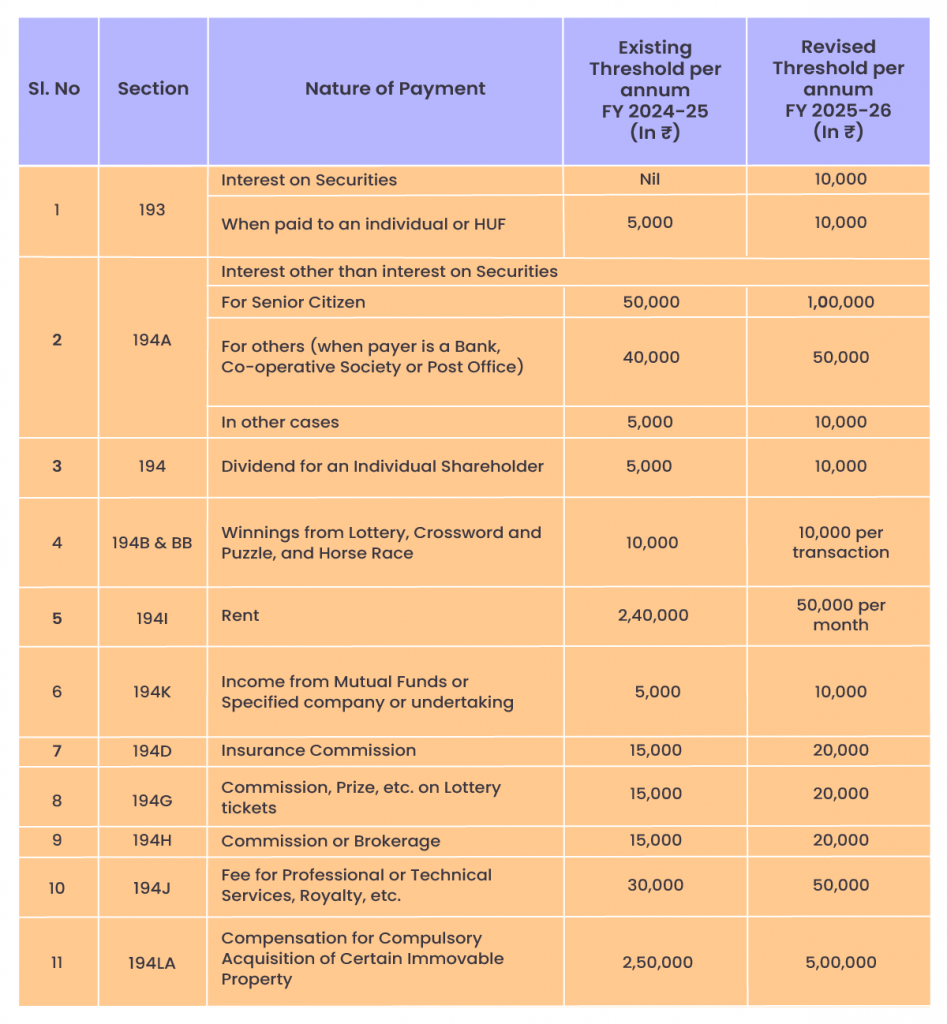

3) Increase in TDS Thresholds

Let us have a quick look at the table below for an overview of the increase in thresholds under TDS provisions from April 1, 2025.

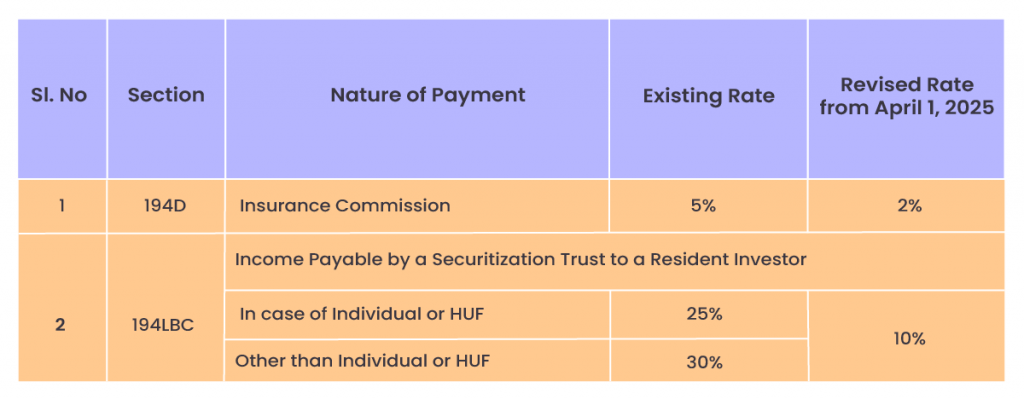

4) Reduction in TDS Rates

Let us have a quick look at the table below for an overview of the decrease in TDS rates from April 1, 2025:

5) Conclusion

The changes in TDS provisions proposed to be effective from April 2025 aim to simplify compliance, ease the tax burdens, and enhance the efficiency of the system for both taxpayers and businesses alike. With increased thresholds, reduced rates, and aimed reforms, these amendments simplify tax deductions while ensuring adherence to tax regulations.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply