Investing in and acquiring the dream home is one of the major ambitions of almost every individual. Considering the gravity of this dream and infrastructure development, the government offers several tax benefits for investments in such asset creations. Here’s a breakdown of the benefits available under the Income Tax Act.

1. Standard Deduction on Income from House Property (Section 24)

While computing the income from house property, the Income Tax Act provides a standard deduction of 30% from the annual value of the property (Annual Value is computed in a specified manner as per provisions of the Income Tax Act).

2. Interest on Housing Loan (Section 24)

Interest paid on housing loans is also eligible for deductions under the Income Tax Act. These deductions vary depending on the type of property.

- Self-occupied or vacant property: Deduction of up to ₹2,00,000 per year, provided the loan is availed for purchase or construction, and the construction is completed within five years. In this case, if construction exceeds beyond five years, the deduction limit is reduced to ₹30,000.

- Let-out property: There is no upper limit on interest deduction. Further, interest on loans taken on repairs, renovation, or reconstructions is also eligible for deduction.

- Pre-construction Interest: Interest paid before completion of construction or acquisition is allowed in five equal installments starting from the year of completion.

- Private Loans: Interest on private loans is also permissible, provided there is a valid interest certificate issued by the lender.

Note: Under the new tax regime, interest is allowed only for let-out properties and not for self-occupied/ vacant house property.

3. Principal Repayment of Housing Loan (Section 80C)

- Loan must be taken for purchase or construction of a house property.

- The principal amount repaid on the home loan, along with incidental expenses such as stamp duty, registration fees, etc. qualifies for deductions under Section 80C.

- This deduction along with other deductions available under Section 80C is capped at ₹1,50,000 per financial year.

- The loan must be from a financial institution as specified in the provision.

Note: This benefit is not available under the new tax regime.

4. Additional Interest Deduction for First-time Home Buyers (Sections 80EE & 80EEA)

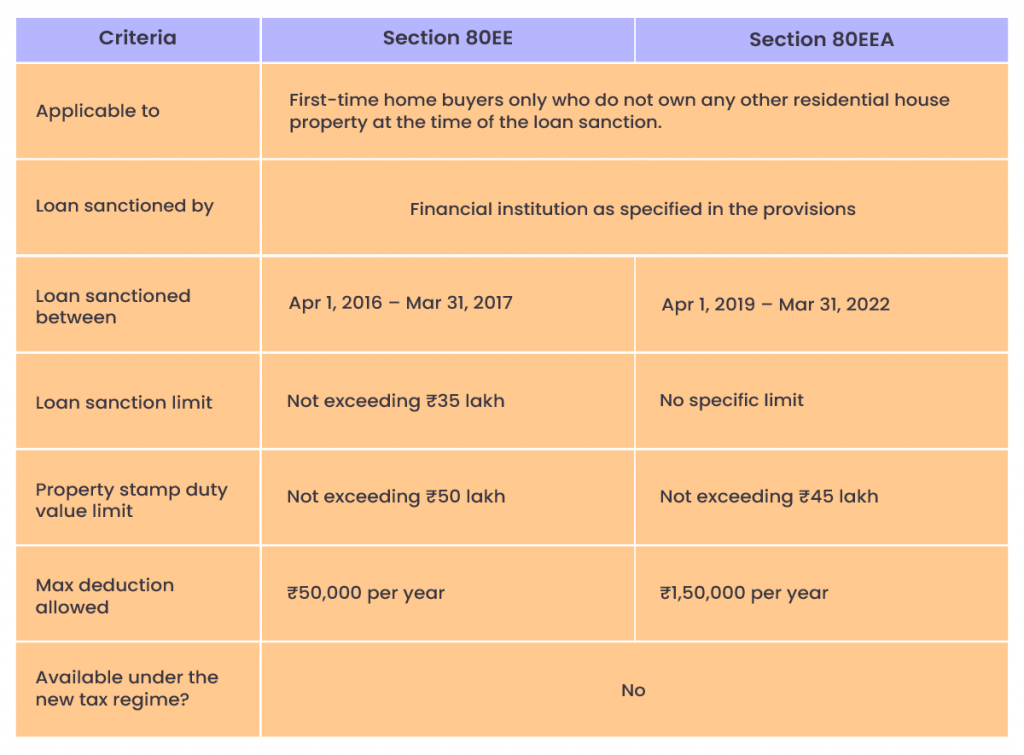

For first-time homebuyers, additional deductions for interest on loans are available under the sections 80EE & 80EEA for acquisition of residential house property. Let’s have a quick look at these deductions below:

Conclusion

Homeowners can take advantage of these benefits to significantly reduce their taxable income while investing in assets. If you are getting ready to purchase your first home or planning to invest in real estate, these deductions are crucial; and you should carry out your financial plannings considering these benefits.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply