A “Will” is a legal document that allows individuals to decide the distribution of their assets after death. It acts as a directive and ensures a smooth transition of a deceased person’s (called the Testator) wealth and assets to the designated heirs, avoiding disputes and legal complications. In this blog, let us discuss the crucial points you need to know about a Will.

Importance and Key Notes of writing a Will

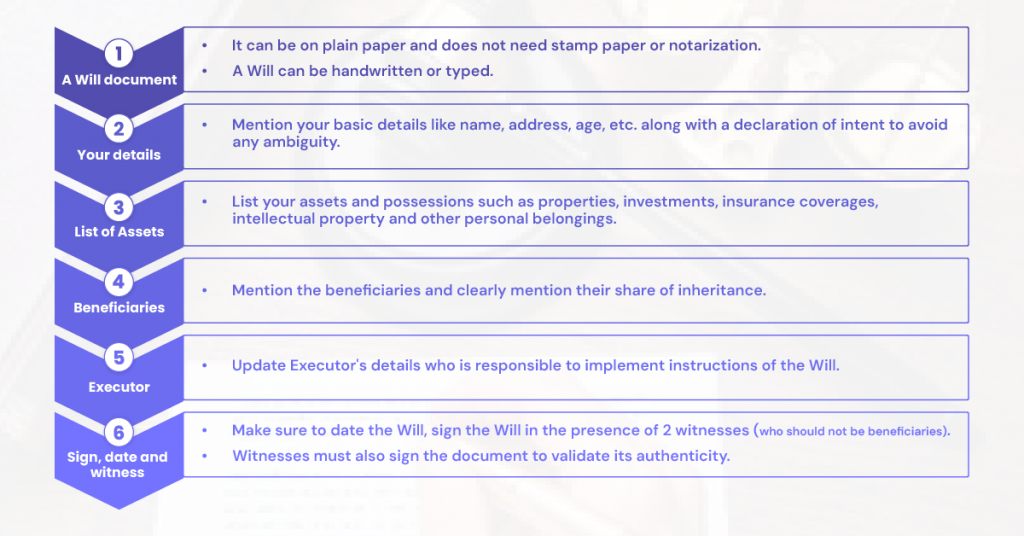

1. Choosing an Executor

- a. The Executor is responsible to carry out the terms of the Will.

- b. Choose a person who is trustworthy and capable of handling legal and financial aspects efficiently.

- c. The Executor can be any adult of sound mind other than a beneficiary of your Will.

2. Dating, Signing and Witnessing

- a. For a Will to be legally valid in India, it must be signed and dated by the Testator in the presence of at least 2 witnesses (other than beneficiaries) who must attest the Will.

- b. Signing can be done through thumb impressions as well.

- c. A Will lacking date and signatures would be considered null and void.

3. Registration of the Will

- a. It is not legally required to register a Will. However, registering it at the Sub-Registrar’s Office adds legal authenticity.

- b. A registered Will remains secure with the registry with restricted access to people other than the Testator and authorized legal heirs.

4. Storing and Updating the Will

- a. A Will should be kept in a safe place such as a bank locker, a lawyer’s office, or with a trusted family member.

- b. It can be updated in the event of major life events such as marriage, childbirth, changes in assets, or changes in the Testator’s wishes.

- c. To prevent confusion, old Wills should be destroyed after creating a new one.

5. A Will has no expiry date

- a. A Will exists and remains effective indefinitely.

- b. However, if a new Will is created, the previous one becomes invalid.

6. Seek legal assistance, if required

- a. A Will can be drafted by the Testators themselves.

- b. If unsure, consult a legal professional for guidance.

7. Protect your legacy in your way

- a. Having a Will is not mandatory. However, without one, assets will be distributed as per applicable personal laws.

- b. Writing a Will ensures you control who inherits your assets and belongings.

Conclusion

A Will that is well-drafted ensures that your wealth passes on to your inheritors chosen by you. Therefore, one must be cautious about the necessary details to be included in the Will to ensure legal compliance and avoid future disputes. By keeping it clear, updated, and safely stored, you can safeguard your desired legacy to be passed on to the future generations in a manner you would want it to be carried on.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply