Building on our previous blogs, which covered tax slabs and key provisions, this post focuses on tax positions across different income levels. In the presence of both old and new regimes, it becomes important to evaluate in choosing the best regime based on specific individual circumstances. The tables below show tax liabilities under both the regimes for FY 2024-25 and FY 2025-2026, highlighting how old and new regimes impact different income levels and break-even points.

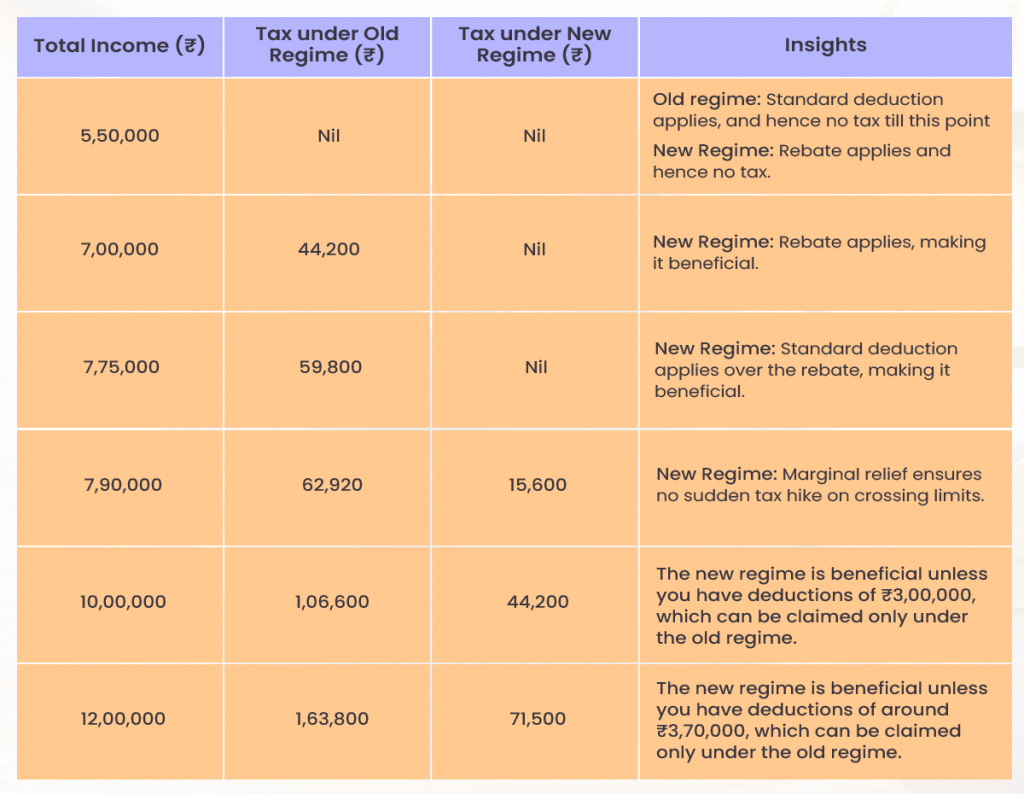

Old vs. New Tax Regime for FY 2024-25: Salaried Individuals

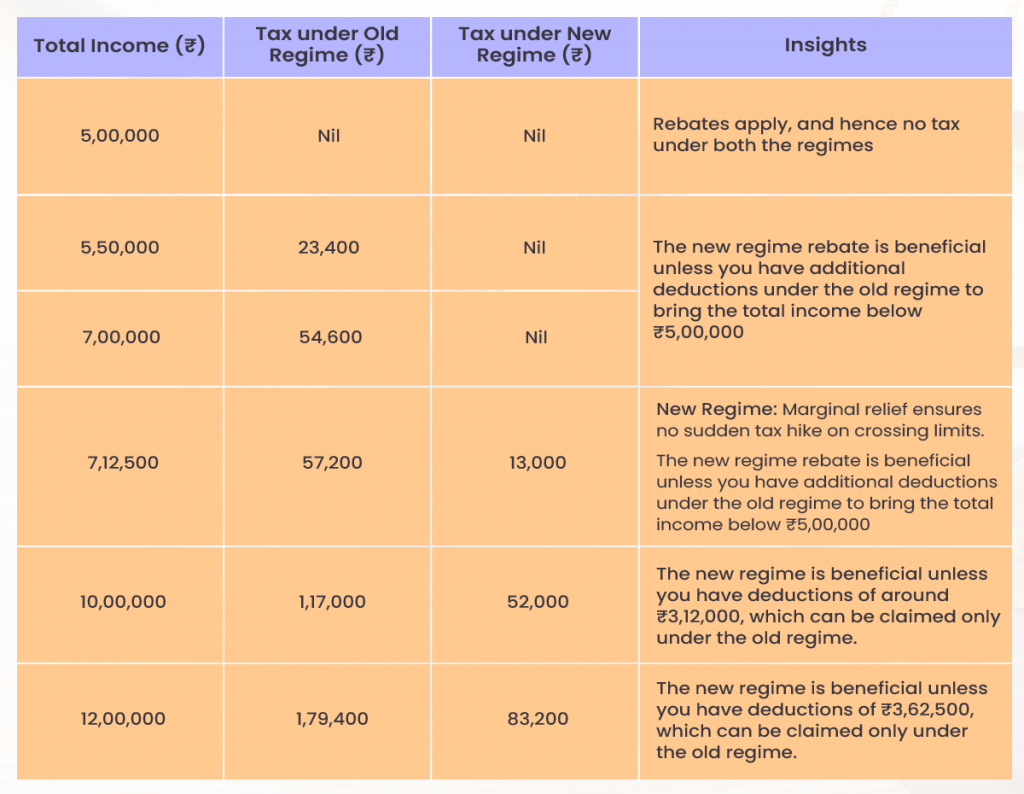

Old vs. New Tax Regime for FY 2024-25: Non-salaried Individuals

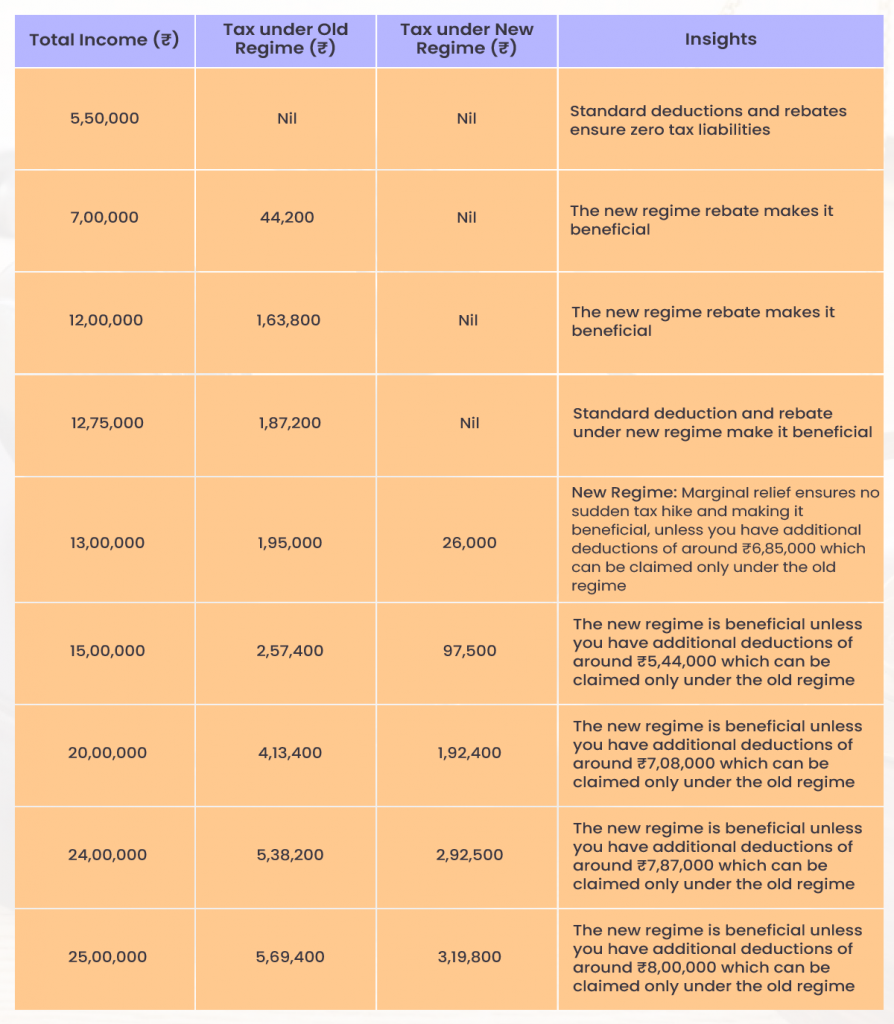

Old vs. New Tax Regime for FY 2025-26: Salaried Individuals

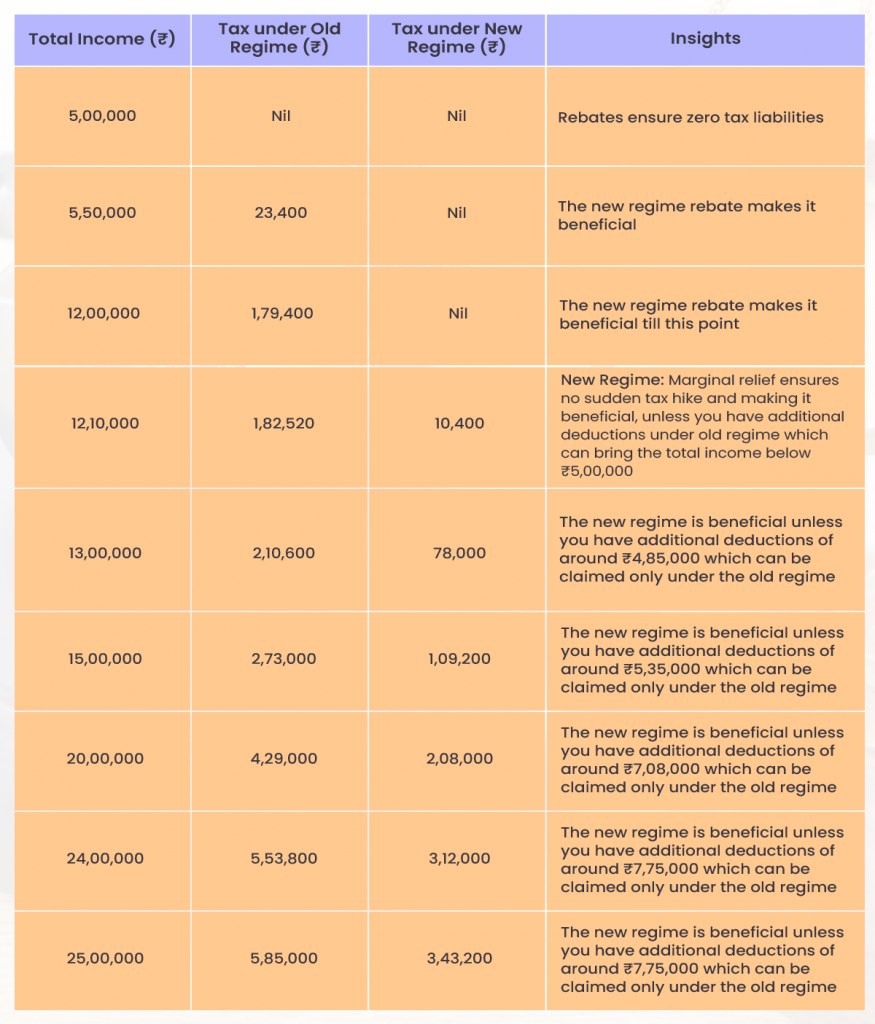

Old vs. New Tax Regime for FY 2025-26: Non-salaried Individuals

Note:

- In all the above tables, total income is assumed to be before standard deductions and after other deductions.

- Under the old regime, it is assumed that individuals are under the age of 60 years. Under new regime, however, it doesn’t matter.

Conclusion

While the old regime allows multiple exemptions and deductions, the new regime provides lower slab rates with fewer deductions allowed. It is important for individual taxpayers to make an informed decision by evaluating their financial positions, investments and deductions available to them under the tax laws. This series of blogs aimed to shed light on various key aspects under individual taxation after incorporating the changes introduced in the Budget 2025.

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply