Overview

The Union Budget 2025, significant revisions to the income tax slabs under the new regime. These revisions are targeted at reducing the financial burden on the taxpayers and boosting overall consumption in the economy. However, many are uncertain about the implications of these changes. This blog serves as an essential reference guide for FY 2024-25 and FY 2025-26 covering key components of the tax computation process.

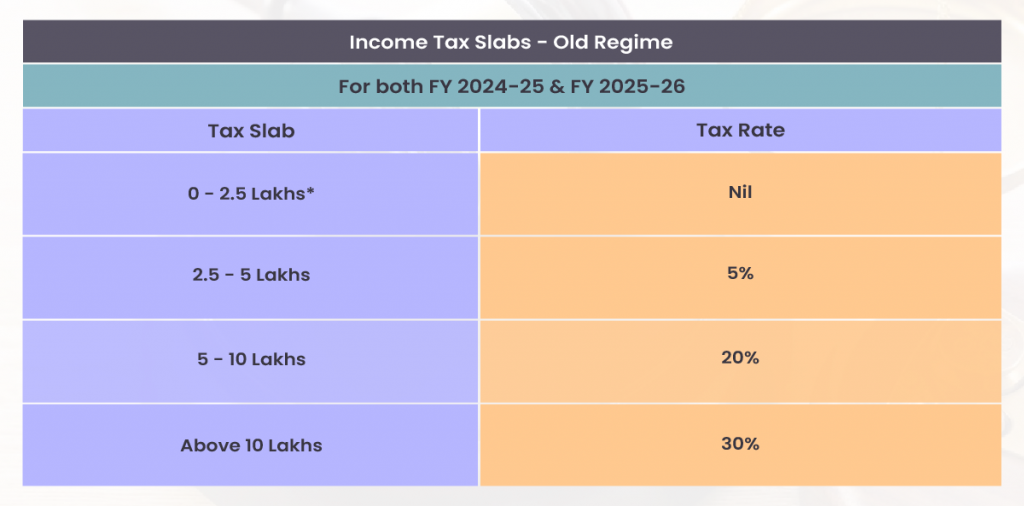

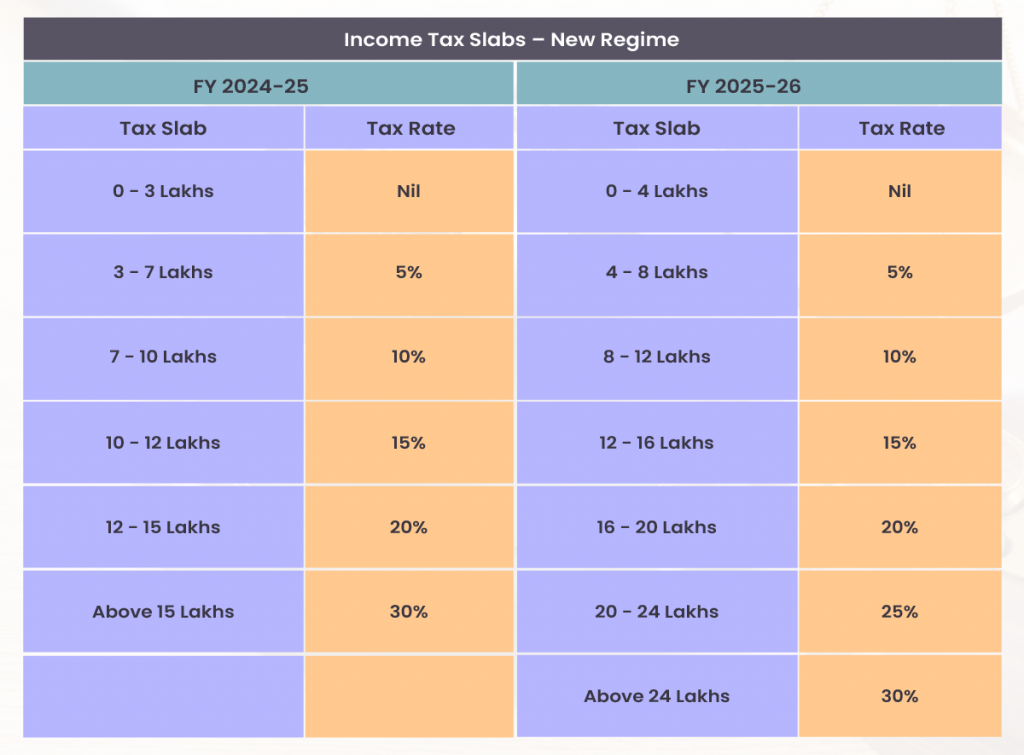

Income Tax Slabs for FY 2024-25 and FY 2025-26 under both the old and new regimes

The newly revised tax slabs will come into effect under the new regime from FY 2025-26 (AY 2026-27). Hence, these changes will have no impact on the computation of income tax for the current year FY 2024-25 (AY 2025-26). Below are the tables outlining the income tax slabs for both regimes for FY 2024-25 and FY 2025-26.

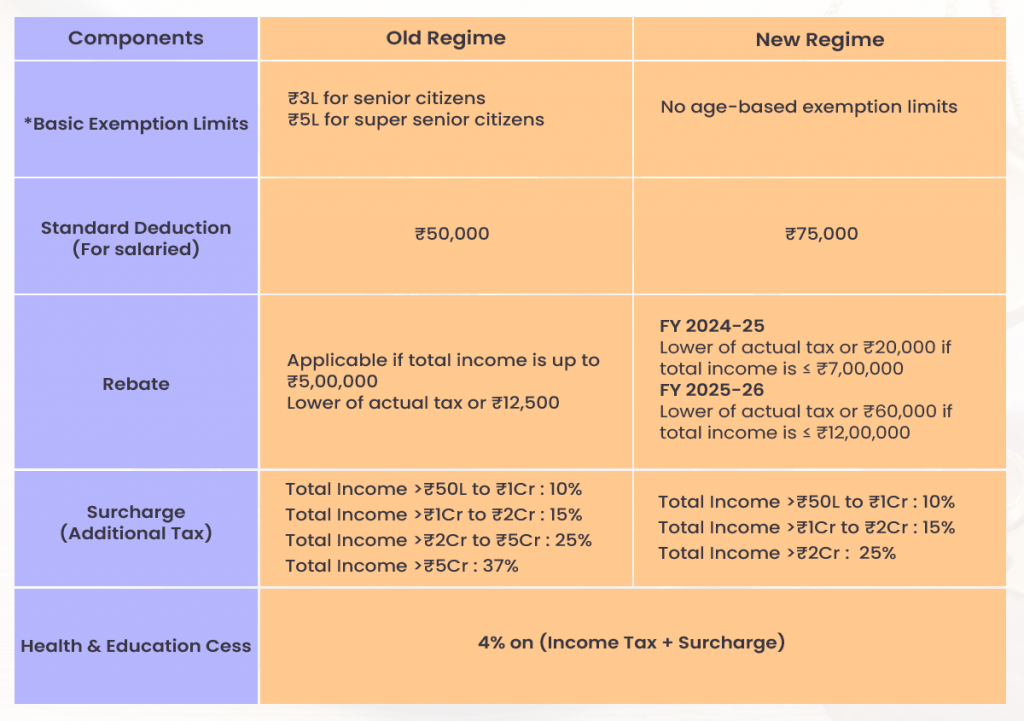

Key components of tax computation

Conclusion

While the revisions in the new regime favor mid-income earners by raising the zero-tax ceiling and enhancing rebate provisions, high-income earners can also benefit from significant tax savings due to the modified slabs. One must choose between the old and new tax regimes based on individual financial circumstances and applicable benefits. Stay tuned for additional insights on these in our upcoming blogs!

Contributors:

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply