Understanding tax concepts is important for any business organisation for the smooth functioning of its operations. One such important thing is the taxes that need to be deducted from certain specified payments including salary. The organisations, which are required to deduct tax at source (TDS) or collect tax at source (TCS), have to acquire a Tax deduction and collection account number (TAN) that is issued by the Income Tax Department.

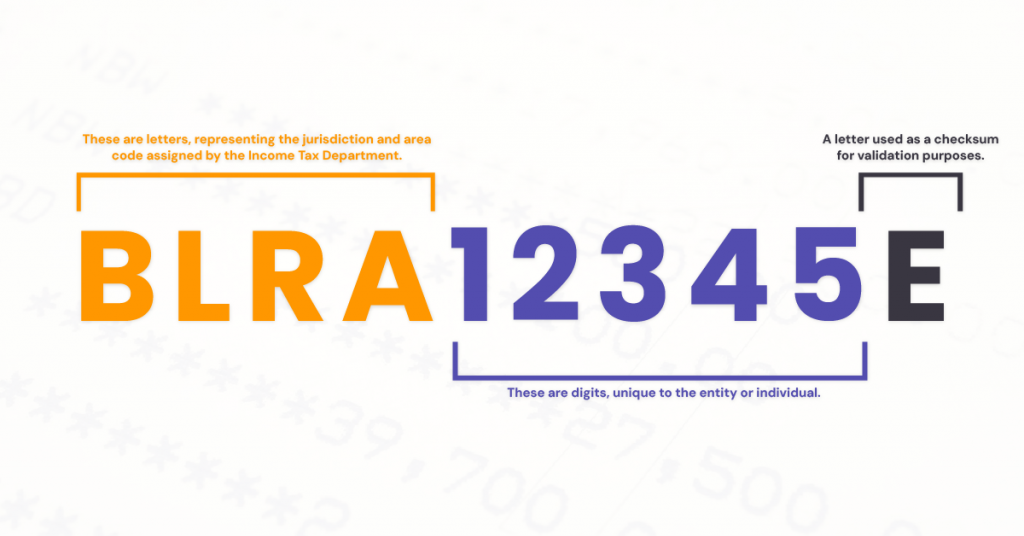

TAN is mandatory for any company, Firm, government department, or certain categories of individual taxpayers. TAN is a 10-digit alphanumeric number where the first 4 components are letters, followed by 5 digits and then one last letter as explained below.

This structure ensures that each TAN is unique and easily identifiable for tax purposes.

TAN: Its Significance & The Process to Obtain It

Obtaining the TAN is a must for any business that is engaged in or required to deduct taxes on salaries, rent, interest, or payments to contractors and professionals. The main objective behind it is to ensure correct reporting and remittance of the tax deductions to the government.

Failure to obtain the TAN could result in legal complications for any business and without it no entity is legally authorized to deduct taxes. Failure to quote a valid TAN or in the occurrence of producing an incorrect TAN, there could be a penalty of INR 10,000 that can be imposed on businesses or individuals by the Income Tax Department. Let’s now quickly have a look at the process and the eligibility criteria to obtain the TAN.

Eligibility

- Any business, individual, or organisation that has got the requirement to deduct or collect tax at source is entitled to it.

- Therefore, any entity that is hiring employees, paying remuneration to professionals, or is engaged in payment to contractors for their work or are required to make such other payments which require tax deduction, should apply for it.

Application Procedure

- Online Application:

- Entities have to apply for TAN online either through the official website of the Income Tax Department or through the NSDL (National Securities Depository Limited) portal.

- Form Submission:

- The application form should be duly filled with details such as the name of the applicant(s), his/her or their entity name, its location, and the PAN (Permanent Account Number).

Documentation Required

- Government recognized identity proof

- Address proof

- Copy of the PAN Card of the applicant or the authorized signatory of the business

Fee Involved

The form of application for obtaining the TAN is available on the above-mentioned portals and is to be submitted with a nominal processing fee of Rs. 77 which is inclusive of the 18% GST applied on it.

Processing Time

The process usually takes 7-10 working days.

Conclusion

Business entities, especially the startup entrepreneurs, must ensure that they apply for and obtain the TAN at the earliest to avoid unnecessary complications. Business organisations with all the valid credentials such as the TAN, help them achieve business goals without the need to tackle unnecessary hassles such as fines and penalties, and also help in building credibility for their business

Contributors:

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn

Leave a Reply